The Sarasota Real Estate Market, along with the rest of the country, has been in transition for several months. Media hype and opinions are wide-ranging…and confusing for buyers and sellers. The shifting of market data points such as slowing sales, declining trajectory of price appreciation, rising inventory levels, longer listing to sale periods and more can be unsettling if you are not using a real estate expert – based in your local market – to help understand the changes.

With more than 40 years in the Sarasota area and having seen a fair number of peaks and valleys in the financial and housing markets, I feel that this is an event that can be called “rebalancing” into a more long-term functionally paced environment.

Markets are truly local, and Sarasota is indeed a unique situation. Sarasota’s commitment to a thriving business sector, quality of life issues and assets, and strong tourism are key elements driving the continued growth of affluent buyers to favor our area. As our market normalizes, meaning that supply and demand gaps are narrowing, our market foundation is strengthening and key fundamentals stabilizing.

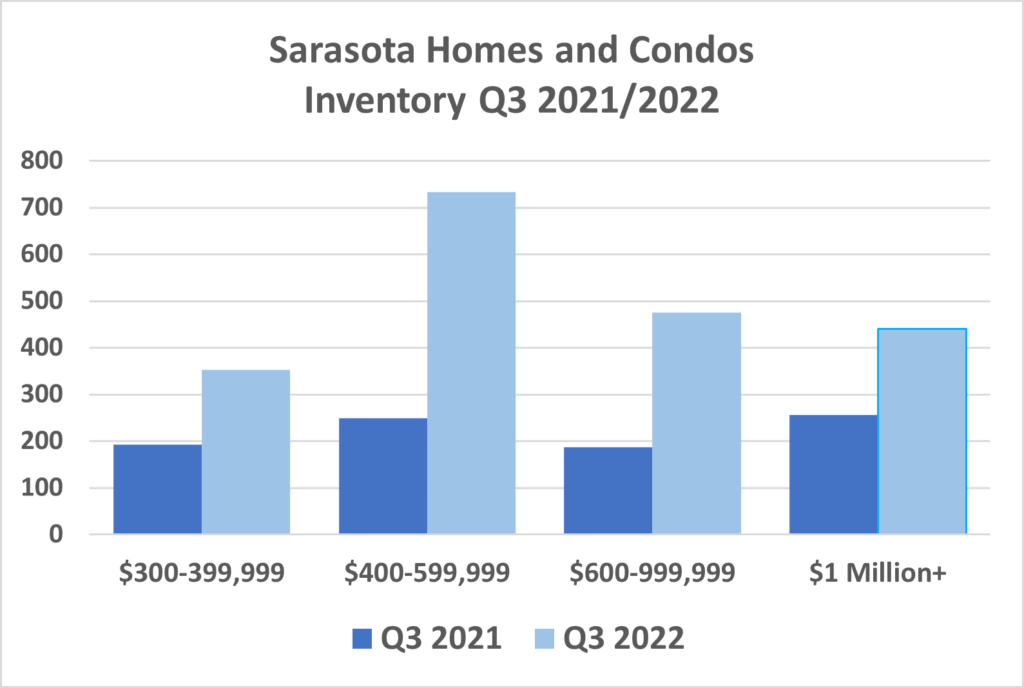

One of the greatest, and more important market conditions that has influenced The Sarasota Real Estate Market over the last two years has been inventory. As noted in my last few reports, growing supply of homes for sale has helped to ease the frenetic pace both sellers and buyers have faced during the years following the onset of the pandemic.

One of the greatest, and more important market conditions that has influenced The Sarasota Real Estate Market over the last two years has been inventory. As noted in my last few reports, growing supply of homes for sale has helped to ease the frenetic pace both sellers and buyers have faced during the years following the onset of the pandemic.

As the attached chart shows, current inventory is a far different image than one year ago. Last year at this time buyers were fighting over less than 1 month supply of properties for sale…compared to this year’s nearly 2 months supply of homes and condos, or almost twice as many to choose from.

During the summer the volume of new listings has fallen compared to the rise we saw in the spring. As our community is so seasonal, it is more typical to see this trend while our part-time residents travel to their summer homes and fulltime residents take time for travel, especially after having to put many family and “bucket list” vacations on hold during for the last 30 months.

Current homeowners who are still sitting on the sidelines cite the home price appreciation pace slowing some, length of time listings are on market growing, and also the impact of growing mortgage rates as reasons they have yet to move forward on selling their home.

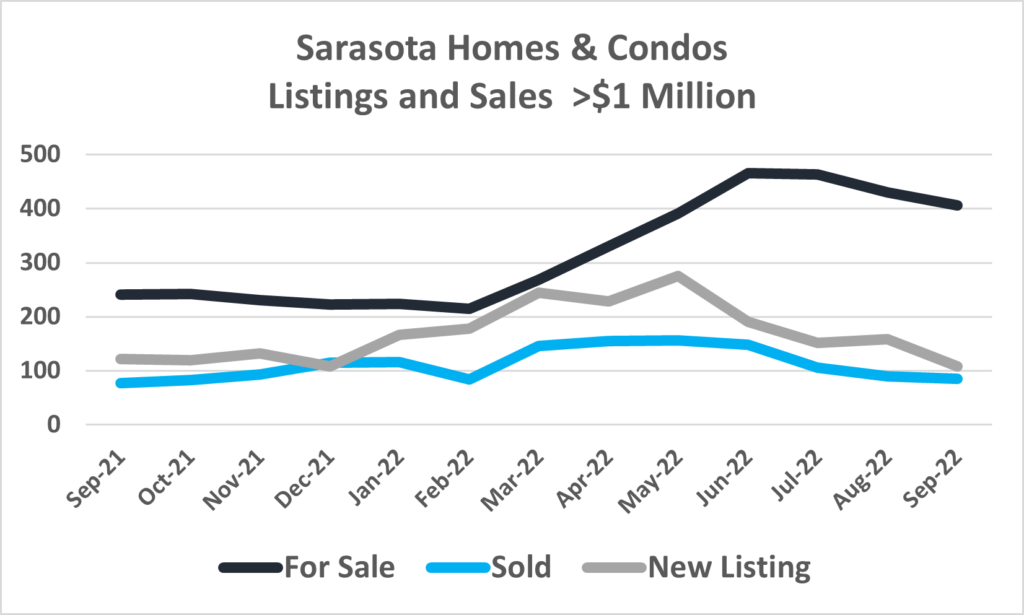

The buyer demand remains strong for high quality and well-located properties in the Sarasota Real Estate Market. I find that my luxury buyers have become a bit more cautious and are moving with less urgency in finding a new property. However, multiple offers and very short list-to-sale- periods for the most coveted condominium and single-family home communities are still very much present.

The need for potential sellers to consider improvements prior to listing will be more important this year than it was in the high-paced environment of 2021, especially as inventory continues to grow and buyers have more to choose from.

The chart here shows how inventory has changed over the last 12 months. Based on my own recent experience and reports from my colleagues,  many would-be sellers are dipping their toe into the market. I believe that the pace of listings over the next several months will bring our inventory to an even more neutral position.

many would-be sellers are dipping their toe into the market. I believe that the pace of listings over the next several months will bring our inventory to an even more neutral position.

National news has been reporting a little uneasiness in the new Home Builder sector. Concerns of continued escalation of mortgage rates is prompting mid-price tier buyers to put their potential purchases on hold; inflationary anxieties cutting home builder budgets and driving construction costs up; and results of the upcoming election possibly altering local as well national economic dynamics; are contributing to slowing pace of traffic to purchase new homes and builders to slow their construction pace.

Here in Sarasota, Home Builders appear to be maintaining an active pace, as is evidenced in the new and growing communities in our eastern county. My expectation is that we will continue to see inventory levels improve in the region both because of new construction as well as increased listings of existing properties.

There is no question that after seeing mortgage rate of 3-4% for much of the last 20 years, 7% may have a significant impact on buyers who need a mortgage. It may also cause would-be buyers who have a low rate to sit tight instead of considering trading to a larger home or new community. In the luxury market where most of my transactions take place, the impact of interest rates is less of a distraction, though I do expect those who took advantage of low rates in the last few years to move to cash in their next purchase.

Though the Sarasota Real Estate Market is in the process of “rebalancing” and some worry about slowing sales when compared to last year, growing inventory, and the pace of appreciation settling down a bit, my experience leads me to believe that we are entering a more normalized housing market and the season ahead will bring great opportunities for both buyers and sellers.

In today’s ever-fluid real estate market, the importance of partnering with a highly experienced, locally as well as globally connected agent/broker, and a skilled negotiator and advocate cannot be overstated.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are achieved.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property.

And now for my statistical report on the September Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in September was $453.8 million, down $150.9 from August and decreased by $155.2 million or 25% from a year ago.

- Broken down, single-family sales were $311 million and condo sales were $142.8 million for the month.

- The number of properties sold in September was 693, which is 473 less than a year ago. The sales total includes 458 houses and 235 condos. The monthly average of sold properties this year is 1,098. The monthly average was 1,369 last year and 1,179 in 2020.

- Florida’s single-family sales decreased 29% from last year, and condo sales were also 29% below last year.

- U.S. sales of single-family homes declined 23% and condos were down 30%.

- Of the closed sales in September, 85 were for over $1,000,000. Of those 56 were houses and 29 were condominiums. In 2021 Sarasota averaged 128 sales per month over a $1 million.

- In September Florida’s homes sold for more than $1 million decreased by 16.8% from prior year, and condos closed at over $1 million fell 13.6%.

- 663 listings went to a pending contract in September, a decrease of 431 transactions from a year ago. Year to date there has been an average of 1,080 pending sales per month. For 2021 the monthly average for pending sales was 1,122 and in 2020 it was 1,264.

- Florida’s single-family pending sales decreased 32% and condos fell 34.6% compared to last year.

- U.S. pending sales in September were 10.2% behind a year ago.

Prices

- Single-family homes were sold at a median price of $497,275. The 2021 monthly average median price for houses sold was $394,000 and this year it is $486,359.

- In September, Florida median price for single-family homes was $403,880, a 13.8% increase over last year.

- The national median price for existing homes grew 8.1% to $391,000.

- The condo median sale price was $399,999. The 2021 monthly median price was $317,000 and this year it is $385,430.

- Median price for a Florida condo In September was $307,250, 20.5% over September 2021.

- U.S. median condo price grew to $331,700, a 9.8% increase from prior year.

- Sarasota houses sold on average for $679,035 for the month. The year-to-date monthly average is $684,708, the 2021 monthly average was $573,000 and in 2020 it was $454,830.

- Condos sold for an average price of $607,711 in September. The year-to-date monthly average is $564,390 and condo monthly average sale price in 2021 was $527,000 and in 2020 it was $382,000.

Inventory

- Currently there are 2,177 properties for sale in Sarasota. There were 829 listings at the end of 2021, 2,272 at the end of 2020, 4,086 at the end of 2019 and 5,401 at the end of 2018.

- The Sarasota market had 852 new listings in September. The market averaged 1,321 new listings monthly in 2021 and this year is averaging 1,363.

- Current inventory results in 2.1 months of single-family homes for sale in Sarasota and 1.6 month’s supply of condominiums.

- Florida currently has 2.5 months of single-family inventory and 2.3 month’s supply of condominiums. Inventory of properties selling for over $1 million have increased more than 50% over last year.

- U.S. inventory of existing homes and condos for sale has fallen .8% from last year, which is a 3.2 month’s supply.