Sales have slowed, the meteoric price appreciation has eased, interest rates are beginning to lower, inventory continues to creep higher…all signs that the Sarasota Real Estate Market is realigning from the unconventional and intense activity, which began in late 2020 and lasted through late spring 2022. As markets of all kinds tend to be cyclical, it is not unexpected to see moderation after the pandemic-induced frenzy.

The changes are increasing days on market between listing and sale, competitive multiple offer conditions are becoming rare, and infrequent offers above asking price all helping to relieve the long-held “seller’s market” that has been in control for the last few years. Though we are still far from the target of six months of inventory available for sale, especially in the lower and mid-tier price points, improved conditions bring the canyon that separated active buyers and sellers closer into alignment.

On a national scale, the perfect storm caused by rising interest rates, higher prices, and tighter budgets that were triggered by inflation has had a considerable impact on the housing market over the last six months. Pending sales have been on a decline for months, and again fell in November. As closings typically don’t happen until 30-60 days after contracts are signed, it is expected that the market’s slowing from prior year will remain.

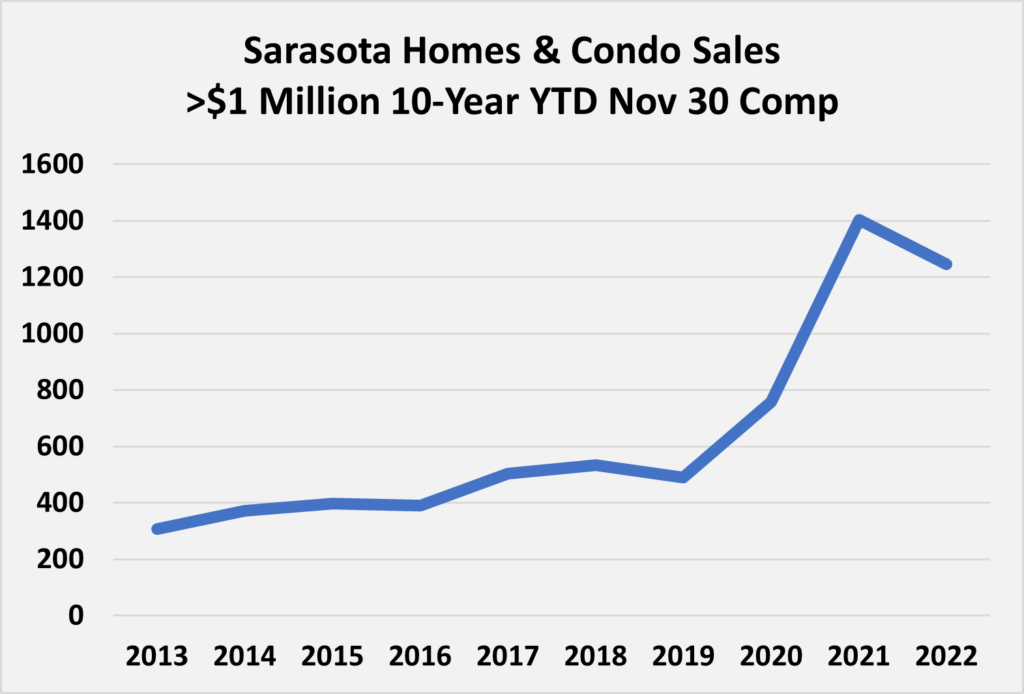

While sales of homes and condos in November fell nearly 50% from prior year, compared to prior month, activity was nearly equal. To see how thiyear’s sales compares to prior years brings the volume into a clearer picture. Using data from Trendgraphix, sales in the luxury price tier, which is over $1 million (and where most of my business occurs), you can see that the number of transactions is still quite remarkable.

year, compared to prior month, activity was nearly equal. To see how thiyear’s sales compares to prior years brings the volume into a clearer picture. Using data from Trendgraphix, sales in the luxury price tier, which is over $1 million (and where most of my business occurs), you can see that the number of transactions is still quite remarkable.

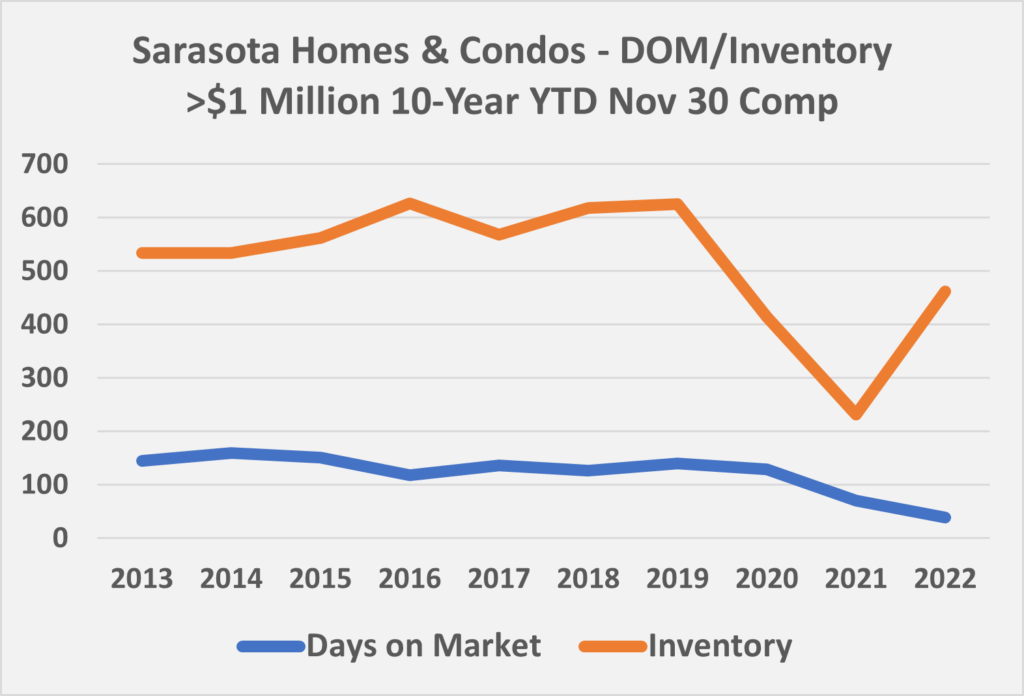

As you can see in the next graph that shows the 10-year track of days from list to sale and inventory levels, again 2022 is well positioned compared to years prior to the pandemic.

Inventory conditions are improving, which in turn is helping to slow price appreciation. As sellers are better understanding buyer expectations, pricing of properties has closed the gap and is helping to shorten list-to-sale periods in the luxury price points.

Across the country, affordability is a key issue influencing the sales decline. The cause lies squarely on the increase in interest rates and inflation, affecting most buyers in the lower to mid-price markets. There is a clear hesitancy for both buyers and sellers as questions about whether now is the time to enter the market cause confusion and concern. Real estate experts and economists are projecting a somewhat humdrum year ahead, with a stronger uptick expected in 2024 after interest rates and inflation stabilize.

Across the country, affordability is a key issue influencing the sales decline. The cause lies squarely on the increase in interest rates and inflation, affecting most buyers in the lower to mid-price markets. There is a clear hesitancy for both buyers and sellers as questions about whether now is the time to enter the market cause confusion and concern. Real estate experts and economists are projecting a somewhat humdrum year ahead, with a stronger uptick expected in 2024 after interest rates and inflation stabilize.

Market analysts recently wrote that return on investment on homes rose an incredible 20% between ’21 and ’22, which is almost three times the 20-year average. Their projections are for it to fall to under 5% in 2023 before rising to a more typical 7-10% in 2024.

As is often said, real estate is local, and our region has entered this quieter environment in a healthy state with continued strong demand. There is great potential to sell well located and move-in ready homes and condos, as well as properties in prized locations that are a perfect site for a custom home.

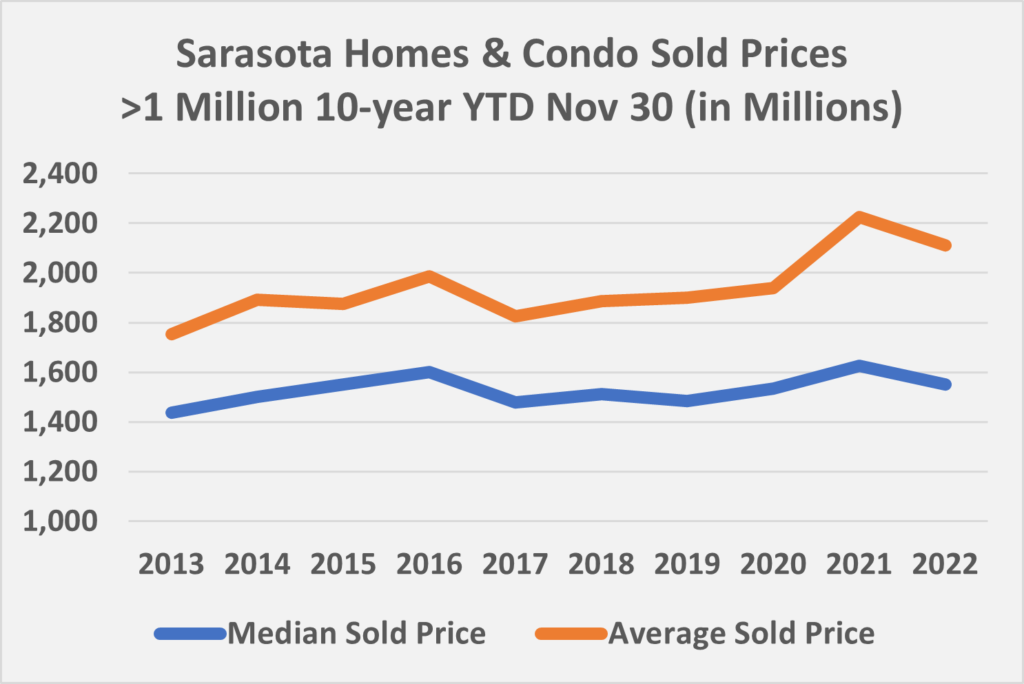

The luxury price tier had significant price escalation mid-2021 through mid-2022, The slight decline in median and average sold prices through November 30, 2022 is not something that worries me. There are often unique events that affect prices, such as a large volume of luxury condominiums selling in a short period as new buildings come online, as did occur in late ’21 and early ’22.

The slight decline in median and average sold prices through November 30, 2022 is not something that worries me. There are often unique events that affect prices, such as a large volume of luxury condominiums selling in a short period as new buildings come online, as did occur in late ’21 and early ’22.

Wealthy clients seeking primary, secondary and investment properties will be relatively unaffected by the interest rate changes expected in 2023, as they see real estate as a key component in their asset portfolio. The affluent who are seeking to buy in this region are eager to find their home, yet patient to wait for “the one” that checks all their boxes. I believe the potential for sales of properties in the upper price points will remain steady in the months ahead.

If we continue to see new listings stay on this slow but steady pace, average prices should also continue to grow, though at a cooler rate than recent past. In my opinion, there are no signs of distress in the luxury market – a cooling yes, but nothing alarming. With several new luxury condo projects under construction and expected to be completed before year-end, this will also help the upper tier move forward in the New Year.

Sarasota’s attractive business climate, no state income and low payroll taxes, great weather and beaches, wonderful culinary and arts community, along with our region being considered “undervalued” compared to other resort communities will keep us as a top location for entrepreneurs to target a move to. As well, those same attributes will continue to attract pre- and early retirement buyers. 2023 looks to be a year of Sarasota Real Estate Market realignment, which will help to augment our region’s historically resilient housing sector.

In today’s unconventional real estate market, the importance of partnering with a highly experienced, locally as well as globally connected agent/broker, and a skilled negotiator and advocate cannot be overstated.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are achieved.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property.

And now for my statistical report on the November Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in November was $394.9 million which decreased by $235.9 million, or down 37% from a year ago. This is the slowest month for closings this year.

- Broken down, single-family sales were $277.6 million and condo sales were $117.3 million for the month.

- The number of properties sold in the month was 638, which is 546 less than a year ago, again the lowest volume this year. The sales total includes 413 houses and 225 condos. The monthly average of sold properties this year is 1,026 where the monthly average was 1,369 last year and 1,179 in 2020.

- Florida’s single-family sales decreased 38.2% from last year, and condo sales were 38.9% below last year.

- U.S. sales of single-family homes declined 35.2% and condos down 37.1%.

- Of the closed sales in November, 56 were for over $1,000,000, 39 were houses and 17 were condominiums. In 2021 Sarasota averaged 128 sales per month over a $1 million.

- Florida’s $1 million+ homes were 32.8% lower than November 2021 and condos closed at over $1 million fell 29.5%.

- In November 712 listings went to a pending contract, a decrease of 426 transactions from a year ago. Year to date there has been an average of 997 pending sales per month. For 2021 the monthly average for pending sales was 1,122 and in 2020 it was 1,264.

- Florida’s single-family pending sales decreased 36.8% and condos fell 42.1% compared to last year.

- U.S. pending sales in November were behind 37.8% from a year ago.

Prices

- Single-family homes were sold at a median price of $499,000, a 19% increase from prior year. The 2021 monthly median price for houses sold was $394,000 and this year it is $492,157.

- In November, Florida median price for single-family homes was $400,000, a 9.6% increase over last year.

- The national median price for existing homes grew 3.2% to $376,700.

- The condo median sale price was $345,000, close to the same as last year. The 2021 average monthly median price was $317,000 and this year it is $381,859.

- Median price for a Florida condo last month was $307,000, a 12.3% increase over November 2021.

- U.S. median condo price grew 5.8% to $321,600.

- Sarasota houses sold on average for $672,234 for the month. The year-to-date monthly average is $683,519 where the 2021 monthly average was $573,000, and in 2020 it was $454,830.

- Sarasota’s condos sold for an average price of $521,235 in November. The year-to-date monthly average is $562,254, compared to $527,000 in 2021 and $382,000 in 2020.

Inventory

- Currently there are 2,410 properties for sale in Sarasota. This is an increase of 163 listings from the month before. There were 829 listings at the end of 2021, 2,272 at the end of 2020, 4,086 at the end of 2019 and 5,401 at the end of 2018.

- Of the available inventory for sale, 486 properties are listed for over $1 million, nearly double November 2021. Of the active listings over $1,000,000, 342 are houses and 144 are condos.

- The Sarasota market had 1,018 new listings in the month. The market averaged 1,321 new listings monthly in 2021 and this year it is 1,285.

- Current inventory results in 2.4 months of single-family homes for sale in Sarasota and 2.1 months supply of condominiums.

- Florida currently has 2.8 months of single-family inventory and 2.7 month’s supply of condominiums. Inventory of properties selling for over $1 million have increased nearly 90% over last year.

- U.S. inventory of existing single-family homes has grown 5.2% and condo inventory is up 5.8%.