May existing homes and condominiums activity Sarasota continued to see strong demand and tight inventory. The luxury tiers of the Sarasota Real Estate Market have experienced a welcome stabilization in the first five months of 2023. Average sold prices have been nearly identical since the start of the year and, while sales have fluctuated a bit, they have also found a normalized pattern when compared to the previous two years.

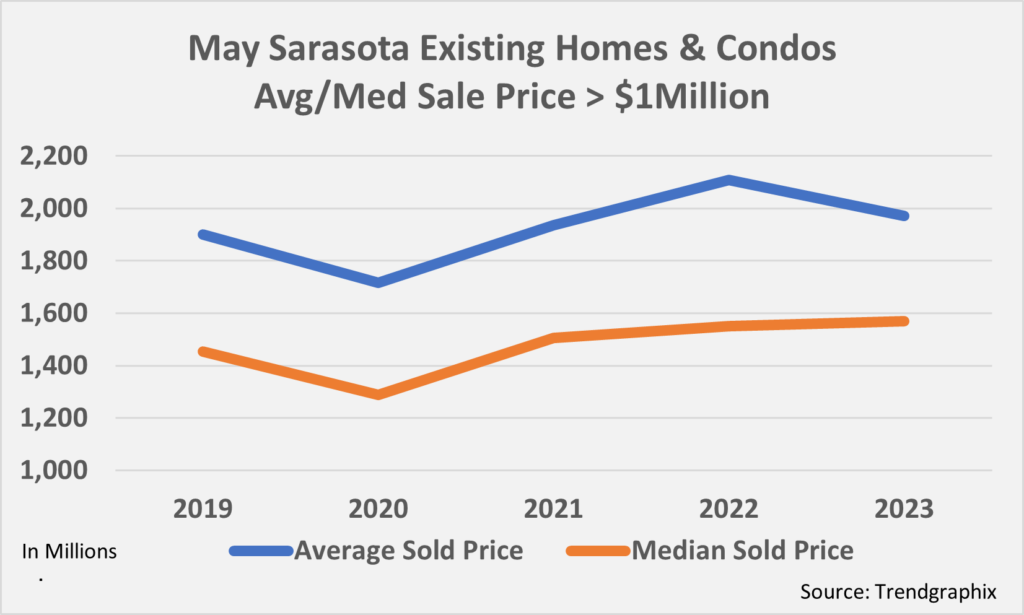

In the attached chart you will see year-over-year five-year comparisons for the Month of May.

Notable is the improvement in inventory for sale in the Sarasota luxury price tiers. Not unusual is also an uptick in the time from listing-to-sale periods as a result of the higher number of properties for sale. When comparing all statistics to pre-pandemic 2019, these data points are still showing growth in the key areas of inventory and prices, and lesser days on market.

Notable is the improvement in inventory for sale in the Sarasota luxury price tiers. Not unusual is also an uptick in the time from listing-to-sale periods as a result of the higher number of properties for sale. When comparing all statistics to pre-pandemic 2019, these data points are still showing growth in the key areas of inventory and prices, and lesser days on market.

Also of importance is taking a look at how pricing is trending. Year-over-year average and median sale prices in the Sarasota luxury market are showing some interesting dynamics. First, as in other data we watch, median pricing continues to grow at a lesser trajectory than during the COVID rush.

Average luxury tier sale price appreciation is tempering as buyers and their realtors are becoming more savvy in negotiating some still elevated seller expectations. Not shown here, but of note, is that in May of 2022 the differential of list-to-sold price was 95% of original listing. In May of 2023 the variance of sold properties was 89% of  listing price. Sellers who are ready to move on with their postponed plans to transition to a new home or condo need to understand current market conditions and joining with an experienced market leader – like me – will deliver the best results.

listing price. Sellers who are ready to move on with their postponed plans to transition to a new home or condo need to understand current market conditions and joining with an experienced market leader – like me – will deliver the best results.

Recent reports on the increasingly strong pace of building and sales of new homes are reassuring, as they are helping to bring our market closer to a balanced position, easing a long-term seller’s market. In May the country’s inventory of properties for sale had new homes representing 31% of the total compared to the norm of 10-15%. This was a 20% increase over last year.

Affluent buyers are focusing their attention on properties that are not just well-located but more importantly centered on well-being. Newer or thoughtfully renovated homes that provide a more “lived in” feeling with comfort, warmth, more options for outside living, smart technology, and wellness amenities better meet this group’s aspirations. In fact, designers are seeing a shift from the cool greys that dominated décor over these last many years. To meet the desire for that more comfortable home, buyers are now favoring palettes with warmer neutrals and furnishings with a softer feel, pops of color, a mix of patterns and natural finishes, and unique showcase pieces to highlight.

Growth in overall inventory is promising, but pace is slow month-to-month and still far from meeting demand. Homeowners sitting on mortgages under 4% are reticent to sell. Industry experts are projecting that interest rates will need to fall to a sustained 5% level to motivate a meaningful number of would-be sellers to list their properties. The 30-year fixed rate rose to over 7% last week.

Despite the interest rate issue and other economic concerns, The Conference Board stated that consumer confidence is currently at a 17-month high. The National Association of Home Builders also reported increased confidence within their membership. While builders continue to face rising costs, supply chain, and labor issues, they feel strongly that demand will keep consumption of new construction swift.

Luxury tier sales of single-family homes and condos have remained relatively stable since the start of the year, with March, April and May all exceeding the previous eight months. Pending contracts signed followed the same pattern. May’s 37% increase from the prior month was clearly tied to the growth in inventory, which has nearly doubled since the same month last year. Stability of average and median sale prices also signals healthy market conditions. I remain confident that demand for high quality and well-located Sarasota homes and condominiums will keep our sales on a similar course for the foreseeable future.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property. Partnering with an agent who understands our nuanced local market, what that means for you, and how it impacts your goals is critical. It is more important than ever to work with a highly experienced, locally as well as globally connected agent/broker, skilled negotiator, and client advocate.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate and guide client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are realized.

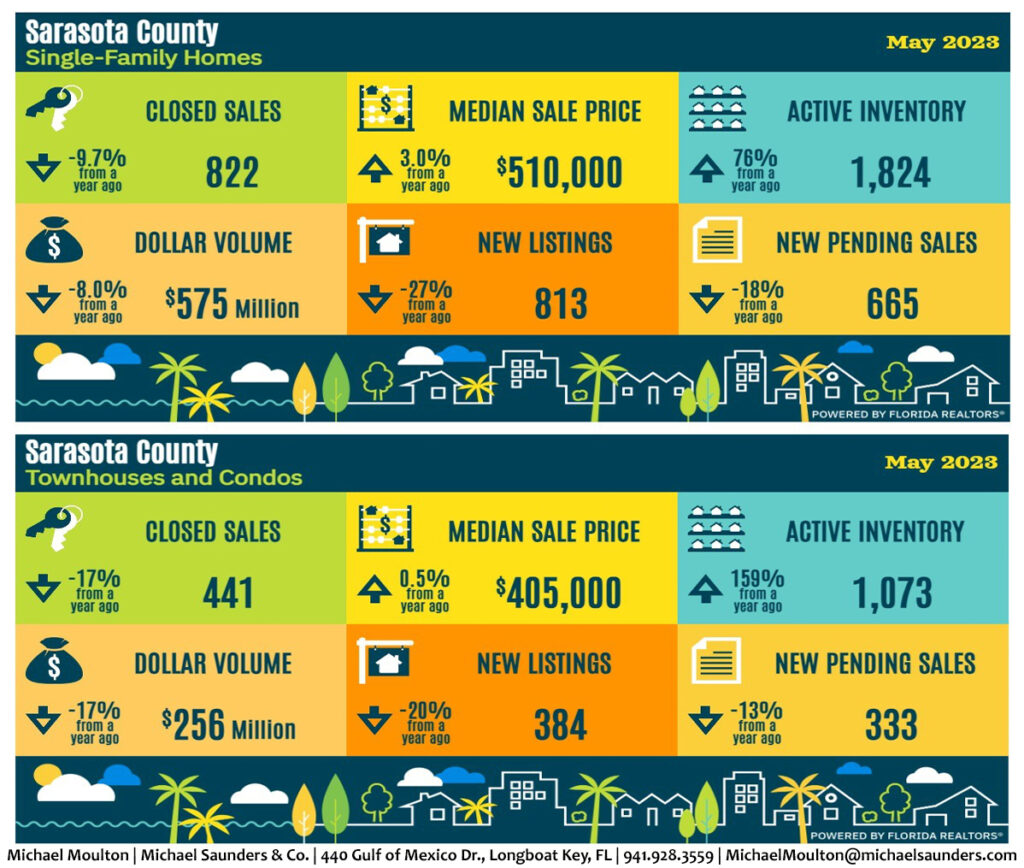

Below is a snapshot using data compiled from the Florida Association of Realtors showing all existing homes and condos activity in March 2023 compared to March 2022:

And now for my statistical report on the May Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in May was $831.4 million which decreased by $101 million from a year ago.

- The number of properties sold was 1,263, only 179 less than a year ago. The monthly average of sold properties this year is 1,213. The monthly average in 2022 was 1,004 and in 2021 1,369.

- Florida’s single-family sales decreased 8.5% from last year, and condo sales were down by 14.1%.

- U.S. sales of single-family homes declined 20% and condos fell 23.7%.

- Of the closed sales in May, 157 were for over $1,000,000. In 2022 Sarasota averaged 111 sales per month over $1 million and in 2021 the average was 128.

- Florida homes sold for in excess of $1 million were 11% lower than May 2022, and condos closed at over $1 million fell 20.5%.

- In May 998 listings went to a pending contract, a decrease of 180 transactions from a year ago. Year to date there has been an average of 1,127 pending sales per month. There were 968 pending sales per month in 2022 and 1,347 in 2021.

- Florida’s single-family pending sales decreased 9.1% and condos fell 11.9% compared to last year.

- U.S. pending sales in May were 22.2% behind May 2022.

Prices

- Single-family homes were sold at a median price of $510,000. The average monthly median price for houses sold is $502,602 this year. In 2022 $493,000 and in 2021 $394,000.

- In May, Florida median price for single-family homes was $419,900, equal to last year.

- The national median price for existing homes fell 3.4% to $401,100.

- Sarasota’s condo median sale price was $328,991. In 2022 $383,000 and in 2021 $317,000.

- Median price for a Florida condo in May was $325,000, a 1% increase over May 2022.

- U.S. median condo price was equal to last year, $353,000.

- Sarasota houses sold on average for $681,888 for the month. The year-to-date monthly average is $682,000. In 2022 $683,000 and 2021 $573,000.

- Condos sold for an average price of $581,564 last month. The year-to-date monthly average is $613,923. The 2022 monthly average was $563,000 and in 2021 it was $527,000.

Inventory

- Currently there are 2,897 properties for sale in Sarasota. At the beginning of this year there were 2,431 listings, 829 at the beginning of 2022 and 2,272 at the beginning of 2021.

- The Sarasota market had 1,197 new listings in May. The market averaged 904 new listings monthly in 2022 and in 2021 it was 1,321.

- Current inventory results in 3 months of single-family homes for sale in Sarasota and 3.5 month’s supply of condominiums.

- Florida currently has 2.7 months of single-family inventory and 3.6 month’s supply of condominiums. Inventory of properties selling for over $1 million have increased about 45% over last year.

- U.S. inventory of existing single-family homes is 6.9% fewer and condo inventory has fallen 1.5% compared to last year.