Following several months of what seemed like a softening of demand from luxury buyers, the upturn in The Sarasota Real Estate Market since the start of 2023 has been tangible. A volatility in financial markets affected the urgency with which buyers felt the need to move, with many potential buyers of high-end properties hitting the pause button. However, since the start of the year buyer activity has grown markedly.

Buyers are still very much engaged and patiently waiting for my call with newly listed properties that check their boxes. Most of these clients will have all-cash transactions and are ready and able to make a quick decision and want swift closing times. And, though the number of multiple offers for best properties have lessened some, there is still competition when great homes come to market. I still advise my clients when they ask what I would recommend they offer, “What price would you not lose sleep over if you lost the property to a higher bidder?”

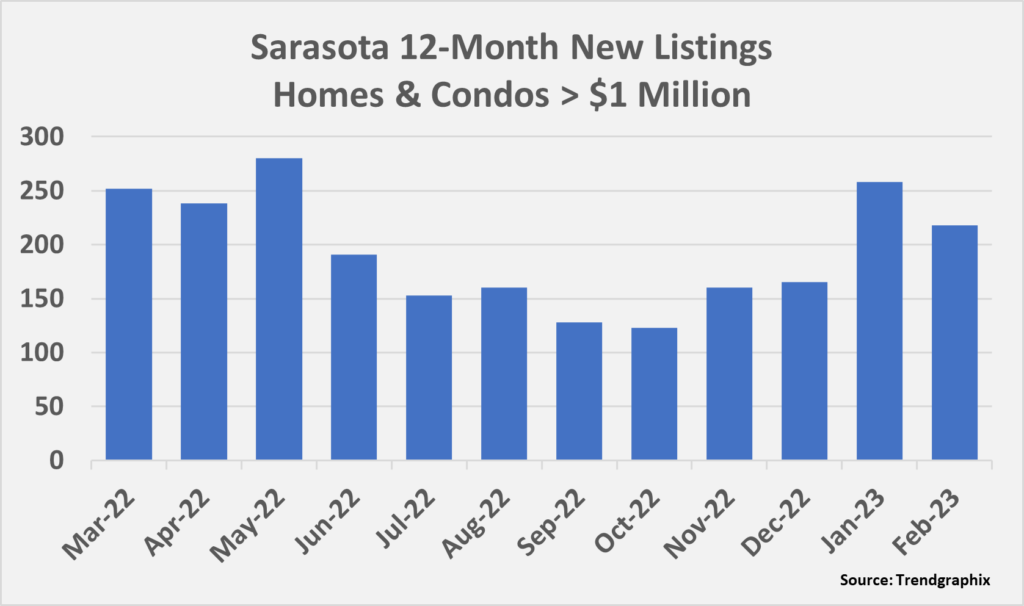

Fortunately, sellers are also beginning to ease back into The Sarasota Real Estate Market. As you will see in the chart, monthly listings have grown since early fall, and based on my prospective seller discussions and conversations with my peers who serve the upper-tier markets, it appears we will see steady new listing activity in the months ahead.

Fortunately, sellers are also beginning to ease back into The Sarasota Real Estate Market. As you will see in the chart, monthly listings have grown since early fall, and based on my prospective seller discussions and conversations with my peers who serve the upper-tier markets, it appears we will see steady new listing activity in the months ahead.

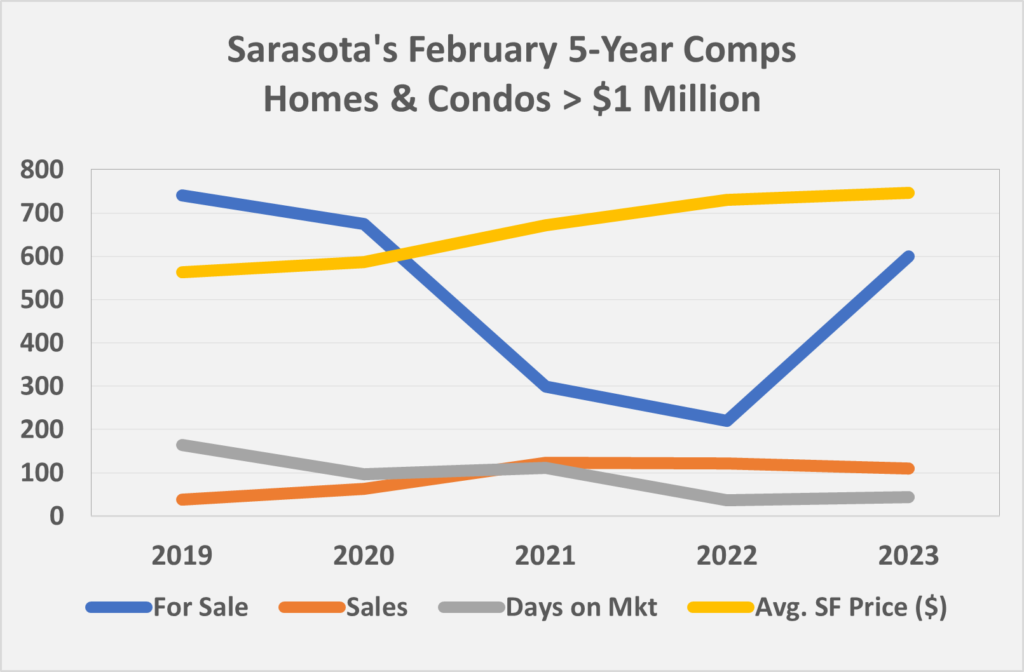

The Sarasota Real Estate Market still has only 2.9 months of inventory of single-family homes and 2.8 month’s supply of condominiums. A balanced market is when available homes and condos for sale is estimated to be a 6-month supply, which we have not seen on a sustained basis since 2011. Continued tight inventory and strong buyer demand will keep monthly price increases or decreases modest. In the next chart you will see that in the luxury price point, our area is seeing an increase in new inventory, but we are still well below historical averages.

Home price appreciation has moderated, so pricing a property has become a bit more complex than during their pandemic period of sharp price escalation. Because the luxury market tier is typically under 200 units sold per month, prices do fluctuate more due to the occasional ultra-luxury sale, or the opening of a new luxury condominium project where many closings occur in a single month.

Home price appreciation has moderated, so pricing a property has become a bit more complex than during their pandemic period of sharp price escalation. Because the luxury market tier is typically under 200 units sold per month, prices do fluctuate more due to the occasional ultra-luxury sale, or the opening of a new luxury condominium project where many closings occur in a single month.

What I thought was somewhat notable in my research was the consistent increase in average square foot sales prices for luxury properties. This is a factor that shows upper tier buyers are still willing to pay top price for a property that meets their needs and aspirations. And, while to some sellers it may feel that their properties are lingering longer before selling, compared to the last five years, note that we are still experiencing remarkably short list to sale periods.

During COVID homeowners saw their housing perspectives shift, generating buyers who are looking for a stronger emotional connection when purchasing a new property. A new alignment of priorities driven by lifestyle and family has emerged, and with remote work policies many more options to choose from. Especially in the luxury marketplace, buyers are more conscious of WHERE they live and WHY they live there.

Luxury buyers of new homes and condominiums are prepared to pay the premium for amenity and technology rich homes and communities…and location. The global (and local) success of hotel branded residences is a great example of upper tier demand. Research has shown that buyers are paying on average 30% more for this new genre luxury lifestyle.

Multiple Ritz Carlton branded buildings in Sarasota are already fully occupied and another is in pre-sale phase, The St. Regis Residences is expected to be complete by year-end, and a new Rosewood property is soon to be built. As well, the construction of extraordinary new homes along Sarasota’s waterfront cannot be missed. I expect the many seeking Sarasota’s unique way of life will boost our luxury market sales activity over the next few years.

Economists are calling for a slight year-over-year decline in total housing sales this year, followed by a 3-5% increase over the next four years. They believe that pace will allow the national housing market to enter a more balanced position. With so many potential buyers either priced out of the market or unable to find a property that meets their needs, a more balanced market will bring sustainability for years to come.

Real estate, however, is hyper-local so news of national and even-statewide conditions can differ relative to Sarasota. An agent who understands the changing market, what that means for you and how it impacts your goals is critical. It is more important than ever to partner with a highly experienced, locally as well as globally connected agent/broker, and a skilled negotiator and advocate.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are achieved.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property.

And now for my statistical report on the February Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in February was $547.3 million which decreased by $62.7 million or 10% from a year ago.

- Broken down, single-family sales were $342.1 million and condo sales were $205.2 million for the month.

- The number of properties sold was 817, which is 188 less than a year ago. The sales total includes 520 houses and 297 condos. The monthly average was 1,004 in 2022, 1,249 in 2021 and 1,179 in 2020.

- Florida’s single-family sales decreased 21.3% from last year, and condo sales were 30.2% below last year.

- U.S. single-family sales fell 21.8% and condos were down 32.5%.

- Of the closed sales in February, 108 were for over $1,000,000, with 59 houses and 49 condominiums sold. In 2022 Sarasota averaged 111 sales per month over $1 million and in 2021 the average was 128.

- In February 1,174 listings went to a pending contract, a decrease of 36 transactions from a year ago. There were 648 pending sales per month on average in 2022 and in 2021 the monthly average was 961.

- Florida’s single-family pending sales decreased 11.6% and condos fell 24.2% compared to last year.

- U.S. pending sales in February were nearly equal to a year ago.

Prices

- Single-family homes were sold at a median price of $495,000. The average median price in 2022 was $493,000 and in 2021 it was $394,000.

- In February, Florida median price for single-family homes was $395,000, a 3.5% increase over last year.

- The national median price for existing homes declined .7% to $367,500.

- The condo median sale price was $368,000. The 2022 average median price was $383,000 and in 2021 it was $317,000.

- Median price for a Florida condo was $315,000, an 8.6% increase over February 2022.

- U.S. median condo price grew 2.5% to $321,000.

- Sarasota houses sold on average for $658,000 for the month, a 4% increase over February 2022. The 2022 annual average was $683,000 and in 2021 it was $573,000.

- Condos sold for an average price of $551,000, which was 25% higher than February 2022. The 2022 annual average was $563,000, in 2021 it was $527,000 and in 2020 it was $382,000.

Inventory

- Currently there are 2,722 properties for sale in Sarasota. At the beginning of this year there were 2,431 listings, 829 at the beginning of 2022, 2,272 at the beginning of 2021, 4,086 at the beginning of 2020 and 5,401 at the beginning of 2018.

- Of the available inventory for sale, 616 properties are listed for over $1 million. Of the active listings over $1,000,000, 431 are houses and are 185 condos.

- The Sarasota market had 1,385 new listings in February. The market averaged 1,105 new listings monthly in 2021 and in 2022 it was 1,720.

- Current inventory results in 2.9 months of single-family homes for sale in Sarasota and 2.8 month’s supply of condominiums.

- Florida currently has 2.7 months of single-family inventory and 3.2 month’s supply of condominiums.

- U.S. inventory of existing single-family homes increased 47% and condo inventory is up 50%, total inventory represents 2.6 months of supply.