There is no question that 2022 saw a significant shift in real estate markets across the U.S. While many regions had posted remarkable increases in sales and prices, they also experienced a sharp decline after the 1st quarter. As you will see in the attached chart, the Sarasota Real Estate Market also felt a decline in sales activity, but when put in context with the previous 10 years, even with a dip the year ended quite significantly above historical averages.

As the FED chose to attempt to tame inflation with increased interest rates, it resulted in turbulence in the stock markets, which made luxury buyers and sellers act more cautiously while they waited for stability to return.

Would-be sellers decided to pull their properties off the market, especially if they were sitting on 3% mortgages. The thought of more than doubling interest on their next purchase was not appealing. The last two years of exceptionally low inventory of homes for sale persists today, keeping us well within a seller’s market, despite moderate increases in homes and condos for sale compared to the start of 2022.

If reviewing sales activity month-over-month, beginning late-spring 2022 activity began to show signs of weakening. However, if compared to a 10-year look at year-over-year, you will see in the chart below:

- Sales over $1 million in 2022 were 52% higher than 2020,

- More than 140% higher than 2019,

- And just under 14% less than 2021.

- In sales for a wider price range – starting at $250K – sales also grew over 2020 by 18%, surpassed 2019 by almost 50%, and down 17% compared to 2021.

Based on my activity, buyers are moving back into the market more quickly signaling that new inventory that comes online will likely see sale periods tight as we move through spring selling season. I am encouraging my buyers to remain agile and ready to act when I find the best property that meets the many unique needs each client has.

Real estate remains a preferred asset and is still considered to be one of the safest investments for luxury tier buyers. Even though the pace of appreciation will ebb and flow, economists believe home values will continue to grow in the coming year. If you are a potential seller, as we enter peak selling season now is a great time to list your property. We are in a market where sitting on the sidelines will likely not result in a sizeable increase in asset value of your current residence.

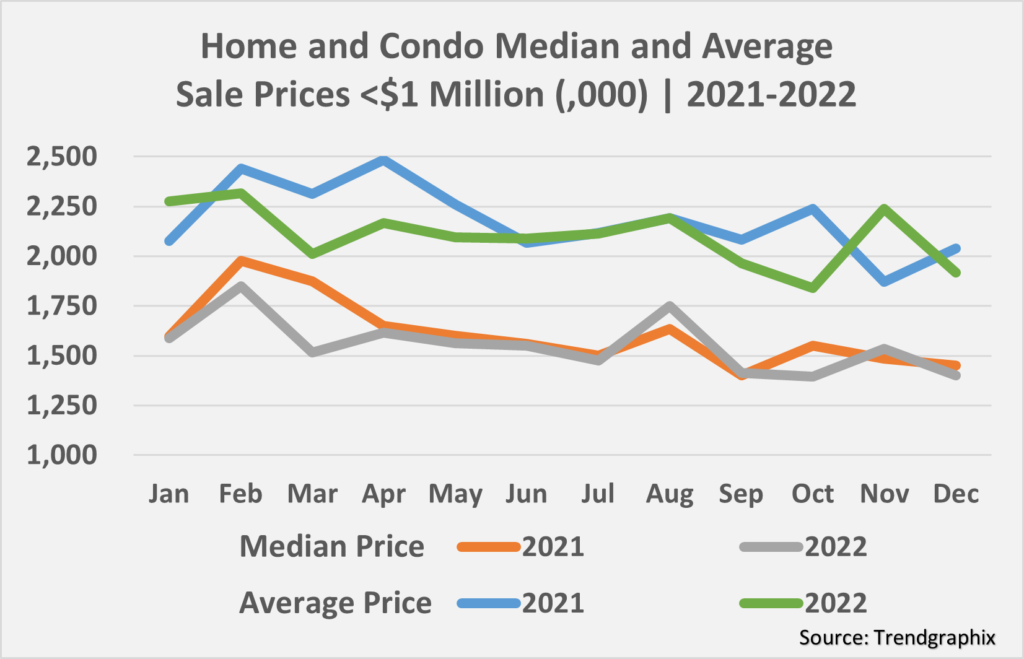

Prices in the Sarasota Real Estate Market are still climbing at double-digit pace, although they have slowed to a more sustainable growth rate. While a slowing market would normally be cause for some concern, the frenzied market we saw for more than two years needed to moderate. Though our area is seeing a tempering of price growth, long-term average home price appreciation is typically 3-4% annually and our region continues to perform well above that level.

Prices in the Sarasota Real Estate Market are still climbing at double-digit pace, although they have slowed to a more sustainable growth rate. While a slowing market would normally be cause for some concern, the frenzied market we saw for more than two years needed to moderate. Though our area is seeing a tempering of price growth, long-term average home price appreciation is typically 3-4% annually and our region continues to perform well above that level.

Experts predict the market will remain softer than 2022 in the first quarter, but instead of creating worry, it needs to be viewed as an adjustment period as we move into a more normalized environment. With the easing of price appreciation, mortgage rates coming down, inflation concerns calming, I believe the Sarasota Real Estate Market will see an increase in activity as the year progresses. 2022 will be known as a year of transition from a seemingly untamed 2020/21.

As we enter second quarter, the pace of sales, appreciation and new listings will return to historic norms. Florida was recently ranked #1 in annual population growth for the first time in more than six decades. This is not just a short-term phenomenon. We should expect our area’s home prices to continue to maintain pace above national averages and sales to return to more normal activity as demand remains high.

New home construction remains robust in the region, helping to sustain our current available housing supply levels. As interest rates begin to stabilize, we will see more sellers reentering the market. Conditions are still not favorable for buyers who face limited inventory in the Sarasota Real Estate Market, but I am optimistic that sales, prices, and inventory will continue to grow in the year ahead.

In today’s ever-fluid real estate market, the importance of partnering with a highly experienced, locally as well as globally connected agent/broker, and a skilled negotiator and advocate cannot be overstated.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are achieved.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property.

And now for my statistical report on the December Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in December was $483.7 million which decreased by $251 million from a year ago.

- Broken down, single-family sales were $326.9 million and condo sales were $156.8 million for the month.

- The number of properties sold was 761, which was 488 less than a year ago. The sales total includes 486 houses and 275 condos. The monthly average of sold properties in 2023 was 1,004 where the monthly average was 1,369 in 2021 and 1,179 in 2020.

- Florida’s single-family sales decreased 36.1% from last year, and condo sales were 40% below last year.

- U.S. sales of single-family homes declined 33.5% and condos were down 38.2%.

- Of the closed sales in December 88 were for over $1,000,000, 55 were houses and 33 were condominiums, which was approximately 25% below prior year. In 2022 Sarasota averaged 111 sales per month over $1 million and in 2021 the average was 128.

- Florida’s homes sold for more than $1 million were off 39.7% from December 2021 and condos closed at over $1 million fell 44.6%.

- In December 648 listings went to a pending contract, a decrease of 1,084 transactions from a year ago. There were 968 pending sales per month on average in 2022 and in 2021 the monthly average was 1,122 and in 2020 it was 1,264.

- Florida’s single-family pending sales decreased 34.5% and condos going under contract fell 39.9% compared to last year.

- U.S. pending sales in December were 37.8% behind a year ago.

Prices

- Single-family homes were sold at a median price of $505,500 in December, a 16% increase over prior year. The 2022 average median price was $493,269 and in 2021 it was $394,000.

- In December, Florida median price for single-family homes was $395,000, a 5.6% increase over last year.

- The national median price for existing homes grew 2% to $372,700.

- The condo median sale price in Sarasota was $390,000 in December. The 2022 median price was $382,537 and in 2021 it was $317,153.

- Median price for a Florida condo was $310,000, an 8.8% increase over December 2021.

- U.S. median condo price grew 3.3% to $317,200.

- Sarasota houses sold on average for $672,688 for the month. The year average is $682,616 where the 2021 monthly average was $573,000 and in 2020 it was $454,830.

- Condos sold for an average price of $570,185 last month. The 2022 monthly average was $563,000, in 2021 it was $527,000 and in 2020 it was $382,000.

Inventory

- Currently there are 2,431 properties for sale in Sarasota. There were 829 listings at the end of 2021, 2,272 at the end of 2020, 4,086 at the end of 2019 and 5,401 at the end of 2018.

- Of the available inventory for sale, 513 properties are listed for over $1 million. Of the active listings over $1,000,000, 348 are houses and 165 are condos.

- The Sarasota market had 1,295 new listings in December. The market averaged 852 new listings monthly in 2022 and in 2021 it was 1,321.

- Current inventory results in 2.5 months of single-family homes for sale in Sarasota and 2.2 month’s supply of condominiums.

- Florida currently has 2.7 months of single-family inventory and 2.7 month’s supply of condominiums. Inventory of properties selling for over $1 million has nearly doubled over last year.

- U.S. inventory of existing properties for sale has increased nearly 70% compared to last year.