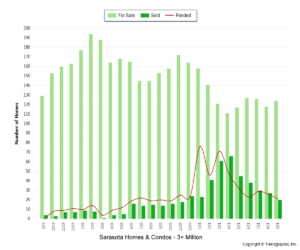

The year 2021 is likely going to finish with the highest volume of luxury transactions in the Sarasota Real Estate Market’s history. As you will see in the attached graphs, luxury tiers between $1-3 million and above $3 million have reached a remarkable pace, causing inventory levels in the segment to fall dramatically and prices to rise.

While $1 million has been the delineation of a “luxury” price-point in the past, here and in many other parts of the country $3 million is becoming the more common threshold as price and net-worth appreciation have grown in the last five years.

As most of my subscribers know, the luxury market is where a majority of my activity occurs. Keeping a close eye on regional trends, as well as hyper-local neighborhood movements is critical to being able to serve my clients – both buyers and sellers.

Who are these Luxury Buyers?

Aside from price, what are luxury buyers seeking? It is something different for everyone. Is yours defined by comforts like outdoor space, expansive kitchen, and large open living areas? Or is it location, views, and nearby amenities? Maybe it is a work of art inside and out.

Aside from price, what are luxury buyers seeking? It is something different for everyone. Is yours defined by comforts like outdoor space, expansive kitchen, and large open living areas? Or is it location, views, and nearby amenities? Maybe it is a work of art inside and out.

Today’s luxury buyers are making their decisions based on their unique priorities. Luxury buyers are seeking one-of-a-kind locations, architecture and interiors, and homes that express their hard-earned success.

With the inventory of $1M and up existing homes and condos available for sale falling from a two-year high in February 2020 of over 550 units on the market, to a low in September of this year of under 200, it is easy to see why price per square foot has increased 20% over that same period.

Sales of properties over $1 million have more than doubled since 2019, and year-to-date in 2021 Sarasota has already exceeded full year sales of luxury homes of 2020.

The greatest influencer in the last year has undoubtedly been the “pandemic migration”. These COVID buyers created the frenzy that lit up our region’s luxury market beginning in summer of 2020.

The greatest influencer in the last year has undoubtedly been the “pandemic migration”. These COVID buyers created the frenzy that lit up our region’s luxury market beginning in summer of 2020.

Though this group is starting to ease, the reopening of international borders is expected to quickly impact our housing market and help to maintain the energy we have been experiencing, but likely at a far less urgent pace. Historically, international buyers are a healthy segment of our buying pool.

A significant outcome of the pandemic is the percentage of second-home buyers and their desire to purchase properties that provide the space, amenities, and lifestyle of their primary homes so that they can spend more time away and move between their homes with ease. In fact, there has been much reported about these new buyers seeking to change their state of residence – for all the reasons we are well aware of.

Existing or New?

Inventory remains the most dominant of all influencers in our market. As I have reported in recent newsletters, existing homes and condos for sale has fallen to the lowest level I can recall in my career.

And, while builders have extremely high confidence in the ability for their new homes and condos to be quickly absorbed, reaching the pace to meet demand remains difficult. What is most appealing to buyers of new construction is the ability to customize interiors, ensure connectivity and tech controls are built-in, seek wellness solutions in air and water purification systems, and security.

Most new condominiums are offering these amenities, while in some single-family developments, some of these are optional and discerning buyers want to be sure they are part of initial construction, and it is of the type and quality they desire.

As far as development to meet this luxury buyer demand, several recently completed projects such as the new Ritz Carlton Residences experienced swift sales. Additional construction is underway on the Quay site with more in approval stages, new buildings are rising in Golden Gate Point, on Lido the announcement of a Rosewood Residences, and on Longboat nearly finished Sage, and soon to rise from the sandy shores there will be the St. Regis Residences.

Drive through Country Club Shores on Longboat, Lido Shores, Harbor Acres and Oyster Bay in the downtown area, and exclusive enclaves in Lakewood Ranch, and you will see hyperactive construction…some renovation and some complete rebuilds – both by owners and on spec.

Time to Enter the Market as a Seller?

In September, the last full month of data that is available, the Sarasota Real Estate Market had a slight deceleration in sales, but prices continued their incredible pace of growth when compared to the rest of Florida and the US. Our inventory is beginning to inch up, as it has the last few months, and price appreciation will return to a more balanced pace.

My advice to sellers is not to join the “aspirational” pricing trend that we have seen recently. My sellers have all heard me say – don’t wait for a better opportunity that may never come!

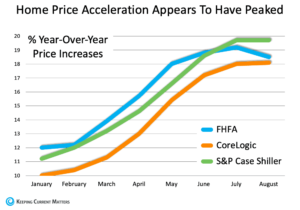

The attached graph from Keeping Current Matters is a great illustration of how price appreciation is leveling off. Annual home price appreciation typically hovers in the 5% range. With current levels near 20% year-over-year growth, industry experts are suggesting that we may have reached a peak, with a leveling off or slight reduction in prices in the year ahead.

The attached graph from Keeping Current Matters is a great illustration of how price appreciation is leveling off. Annual home price appreciation typically hovers in the 5% range. With current levels near 20% year-over-year growth, industry experts are suggesting that we may have reached a peak, with a leveling off or slight reduction in prices in the year ahead.

Depend on your real estate professionals to guide you in setting your price realistically. This is the time to take advantage of today’s seller’s advantages such as shorter list-to-close times, fewer contingencies, and a larger buyer pool, as well as the upcoming seasonal swell in tourism and foreign investors.

Sarasota remains a hot commodity to those looking to relocate and purchase second homes. Our attractive lifestyle, amenities and economic vitality will continue to win us accolades such as the recent US News and World Report’s #1 Place to Retire, and Travel & Leisure’s one of the 10 best beach towns to live in. Over the next year I expect a less frenzied Sarasota Real Estate Market, but one that continues to grow and prosper.

As you consider your real estate goals for the year ahead, whether buying or selling, having a professional with a critical and analytical approach, an understanding of the realities, and able to set expectations based on pragmatic and practiced conclusions will ensure your goals are achieved.

With decades of experience managing hundreds of transactions, and experiencing the Sarasota Real Estate Market’s variability, my knowledge throughout the region can help. Whether looking to relocate to a new neighborhood, considering upsizing or downsizing, or adding to your real estate portfolio, I would be happy to discuss your next steps with you.

And now for my statistical report on the September Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in September was $609 million, which increased by $44.4 million from a year ago.

- Broken down, single-family sales were $438.3 million and condo sales were $170.7 million for the month.

- The number of properties sold in September was 1,166, which is 130 less than a year ago. The sales total includes 835 houses and 331 condos. The monthly sold properties average this year is 1,432; and was 1,179 in 2020; and 1,074 in 2019.

- Florida’s single-family sales decreased by 1.3% from last year, and condo sales were up 4.9%.

- U.S. single-family sales declined 3.1% and condo sales grew 4.5%.

- Of the closed sales in September, 79 were for over $1,000,000, 50 were houses and 29 were condominiums.

- In 2020 Sarasota averaged 50 house sales and 23 condo sales per month over a $1 million.

- 1,094 listings went pending in September, a decrease of 274 transactions from a year ago. For 2020 the monthly average for pending sales was 1,264 and this year it is 1,429.

- Florida’s single-family pending sales decreased 6.1% and condos fell 3.0% compared to last year.

- U.S. pending sales in September were 8% behind a year ago.

Prices

- Single-family homes were sold at a median price of $407,000. The 2020 monthly median price for houses sold was $321,000.

- In September, Florida median price for single-family homes was $355,000, an 18.3% increase over last year.

- The national median price for existing homes grew 13.8% to $359,700.

- The condo median sale price in Sarasota was $325,000. The 2020 monthly median price was $255,000.

- Median price for a Florida condo was $255,000, a 17.2% increase over September 2020.

- U.S. median condo price grew 9.3% to $297,900.

- Sarasota houses sold on average for $524,901, whereas the 2020 monthly average was $455,000.

- Condos sold for an average price of $515,753 in September. The condo monthly average sale price in 2020 was $382,000.

Inventory

- Currently there are 1,087 properties for sale in Sarasota. There were 2,272 at the end of 2020; 4,086 listings at the end of 2019; and 5,401 listings at the end of 2018. This clearly reveals the seller’s market we are in locally.

- Of the available inventory for sale, 256 properties are listed for over $1 million.

- The Sarasota market had 1,264 new listings in September. The market averaged 1,040 new listings in 2019, and this year it is 1,394. Of the new listings, 119 properties were listed over $1,000,000.

- Current inventory results in 0.8 months of single-family homes for sale in Sarasota and 0.6 month’s supply of condominiums.

- Florida currently has 1.3 months of single-family inventory and 1.7 month’s supply of condominiums. Inventory of properties selling for over $1 million has decreased nearly 30% in the last year.

- U.S. inventory of all existing properties for sale has fallen 13% to 2.4 months of inventory.