As buyers in the mid-tiers of the Sarasota Real Estate Market have hit the pause button to wait out rising interest rates, increases in housing prices, and an improvement in inventory, luxury buyers appear to be staying on pace with their purchases.

The Fed’s rapid increase in interest rates as a strategy to regulate the economy has resulted in the same pace of increase in borrowing rates. Though mortgage rates are still well below historical averages, they are now nearly twice what they were last year at this time. Most sales in the mid-tier sectors rely on mortgages, thereby reducing a buyer’s budget or creating hesitancy in buying a home until they feel rates have stabilized.

Rising interest rates are also a disincentive for existing homeowners to list their properties, as most in the mid-price ranges will need to borrow for their next property. This conundrum has caused listings of properties under $1 million to stall significantly, and sales to drop more than 50% year-over-year.

However, in the luxury tiers over $1 million, October experienced 80% growth in sales and a steady flow of new listings coming to market compared to last year. Most luxury buyers are using alternative financing strategies for their purchases, including full-cash transactions, which are not affected by interest rate fluctuations.

In addition, during volatile economies, affluent buyers are driven more by quality of life and the sense that real estate is a safe long-term investment.

Those Fed market strategies noted earlier have also created volatility in the investment markets and fear of a potential recession, compelling even more affluent buyers to consider moving their money into vacation or investment property.

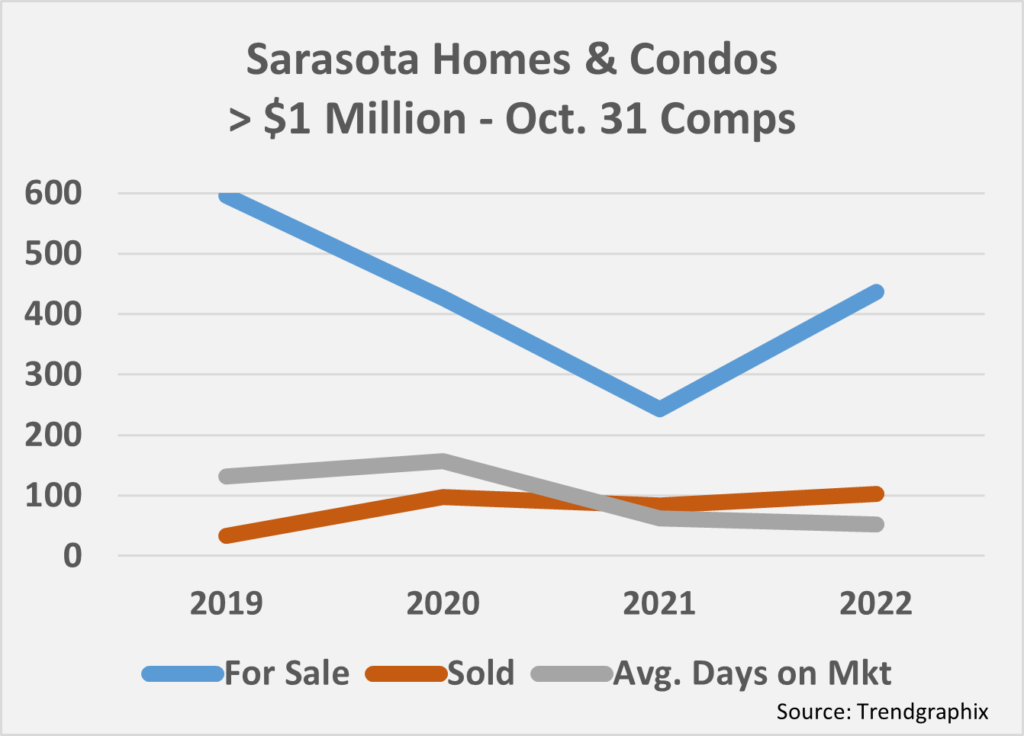

In the attached chart you will see how Sarasota’s luxury sector has fared month-end October over the last four years when comparing inventory, sales, and length of time from listing to sale.

In the attached chart you will see how Sarasota’s luxury sector has fared month-end October over the last four years when comparing inventory, sales, and length of time from listing to sale.

Many seeking homes in the Sarasota area have been on the hunt for some time. They have narrowed their search to specific communities, neighborhoods, and buildings – some precise addresses or condominium numbers. They can wait, their means of purchasing is established, but I am seeing their price expectations very firm. Sellers are realizing that the days of multiple offers over list price as seen these last few years has faded, and it is time to align with buyer value expectations more closely.

The Sarasota Real Estate Market is known for its value when compared to other highly desired resort areas, and our properties will hold their value over the long-term. These factors help both domestic and international buyers consider our region a “safe haven” for their real estate investment.

Economists believe that it is likely the US economy may move into a modest recession in early 2023, which should influence the Fed to pull back on rates creating a more normalized/flat rate environment by mid-year. Because of the relative strength of the real estate market’s foundation, it is expected that housing will be a catalyst to lead the economy out of what is predicted to be a brief recession.

Though year-over-year sales, inventory, and pending sales have slowed, they are similar to pre-pandemic levels. Inventory in all price points is still at historically low levels, and demand remains high. Prices in our region continue to grow at a pace well above Florida and US markets, leading me to believe that The Sarasota Real Estate Market will stay stable during the bumpy economic months ahead.

In today’s ever-fluid real estate market, the importance of partnering with a highly experienced, locally as well as globally connected agent/broker, and a skilled negotiator and advocate cannot be overstated.

Having served clients in The Sarasota Real Estate Market for 40 years and carefully analyzing our business conditions, I have developed essential insight to assist both buyers and sellers in achieving their objectives. An understanding of the realities, the ability to evaluate client expectations, and expert management in negotiating the purchase or sale of a home or condo, I ensure that your goals are achieved.

It would be my privilege to work with you, your family, and friends in acquiring or selling your property.

And now for my statistical report on the October Sarasota Real Estate Market activity:

Sales

- Total market dollar volume in October was $506.9 million which decreased by $106.5 million or 17% from a year ago.

- Broken down, single-family sales were $360.9 million and condo sales were $146 million for the month.

- The number of properties sold was 770, 337 less than a year ago. The sales total includes 520 houses and 250 condos. The monthly average of sold properties this year is 1,065 whereas the monthly average was 1,369 last year and 1,179 in 2020.

- Florida’s single-family sales decreased 24.6% from last year, and condo sales were 26.9% below last year.

- U.S. sales with single-family sales declined 28.2% and condos were down 30.4%.

- Of the closed sales in October 105 were for over $1,000,000, 72 were houses and 33 were condominiums. In 2021 Sarasota averaged 128 sales per month over a $1 million.

- Florida homes sold for more than $1 million were down 6% from October 2021 and condos closed at over $1 million fell 6%.

- In October 531 listings went to a pending contract, a decrease of 673 transactions from a year ago. This is the first month this year with under 600 transactions. Year to date there has been an average of 1,025 pending sales per month. For 2021 the monthly average for pending sales was 1,122 and in 2020 it was 1,264.

- Florida’s single-family pending sales decreased 41.2% and condos fell 42.5% compared to last year.

- U.S. pending sales in October were 37% behind a year ago.

Prices

- Single-family homes were sold at a median price of $537,500, up 31% from last October. The strong luxury market and quiet low- and mid-tier housing activity is creating an elevated median price for the area. The 2021 monthly median price for houses sold was $394,000 and this year it is $491,473.

- In October, Florida median price for single-family homes was $401,990, an increase of 12% over last year.

- The national median price for existing homes grew 6.2% to $384,900.

- The condo median sale price in Sarasota was $386,5809. The 2021 monthly median price was $317,000 and this year it is $385,545.

- Median price for a Florida condo last month was $310,000, a 19.2% increase over October 2021.

- U.S. median condo price grew 10.1% to $331,000.

- Sarasota houses sold on average for $684,106 for the month. The year-to-date monthly average is $684,648 where the 2021 monthly average was $573,000 and in 2020 it was $454,830.

- Condos sold for an average price of $584,051 last month. The year-to-date monthly average is $566,356 and condo monthly average sale price in 2021 was $527,000 and in 2020 it was $382,000.

Inventory

- Currently there are 2,247properties for sale in Sarasota. This is an increase of 70 listings from the month before. There were 829 listings at the end of 2021, 2,272 at the end of 2020, 4,086 at the end of 2019 and 5,401 at the end of 2018.

- The Sarasota market had 854 new listings the past month. The market averaged 1,321 new listings monthly in 2021 and this year it is.

- Current inventory results in 2.2 months of single-family homes for sale in Sarasota and 1.8 month’s supply of condominiums.

- Florida currently has 2.7 months of single-family inventory and 2.5 month’s supply of condominiums. Inventory of properties selling for over $1 million have more that 50% over last year.

- U.S. inventory of existing single-family homes has grown only slightly from same time last year to 3.3 months of supply, Condo inventory has dropped 15.3% to 3.5 months.