As 2021 wound down, activity remained brisk in the Sarasota Real Estate Market. At year-end, sales for all price points and all existing homes and condominiums increased 17.5% over prior year, inventory of properties for sale fell almost 40%, the price paid increased 27%, and listing prices jumped 50% from year-end 2020. In December, the number of days on market before going into contract was just 7 days! Each is a remarkable statistic by itself.

As the calendar rolled to 2022, the pace of inquiries has been incredibly high, and my expectation is that first quarter 2022 will maintain the momentum of last year. The days of well-ordered preparations for listing a property, photography and videography, global marketing, open houses, and lingering inventory requiring price “adjustments” appears to be history – for now.

Sellers who had been hesitant to list their homes are now quietly working with the area’s most respected realtors. Our long-standing relationships have allowed us to build a cache of clients waiting for just the right property to come available – and with cash in hand to expedite a transaction.

For homebuyers in the lower price tiers, these conditions have put many in untenable situations, and without optimism that this year will be any different in achieving their dream of being a homeowner. And with rising rents throughout our region, housing for our workforce has become a challenge. Fortunately, several promising projects have been proposed for both our downtown areas and more suburban settings that will help this important community demographic in the year ahead.

10-Year Snapshot

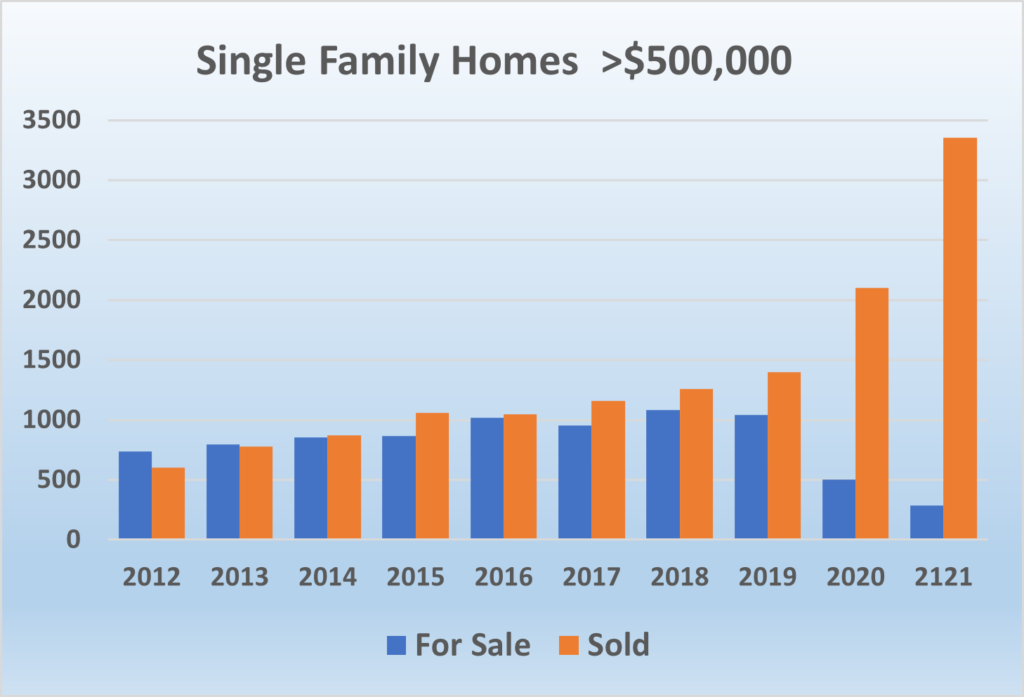

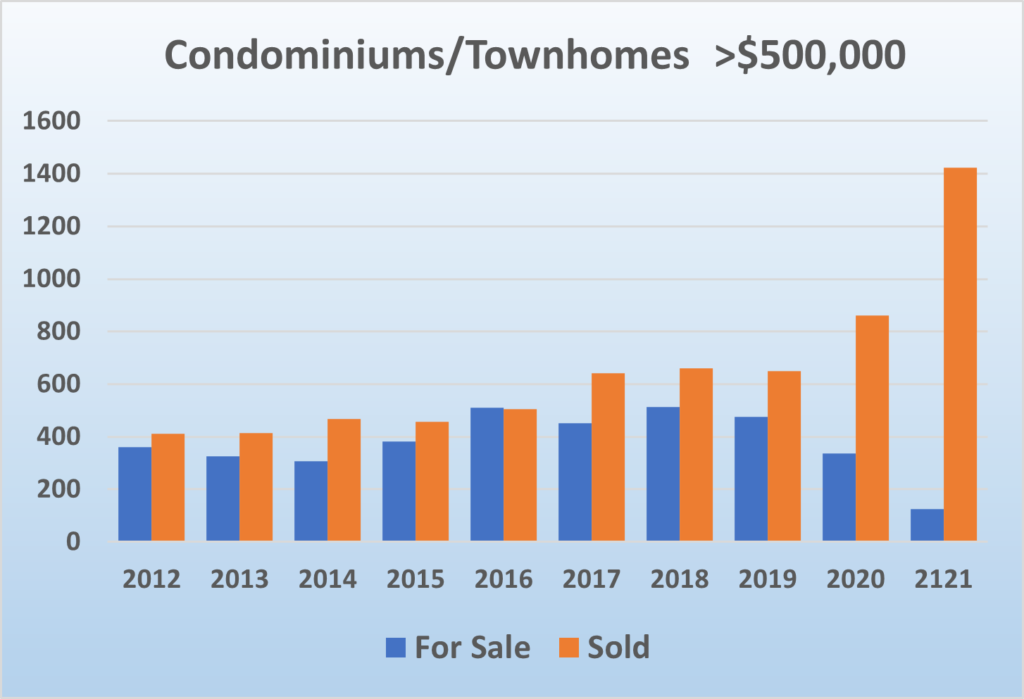

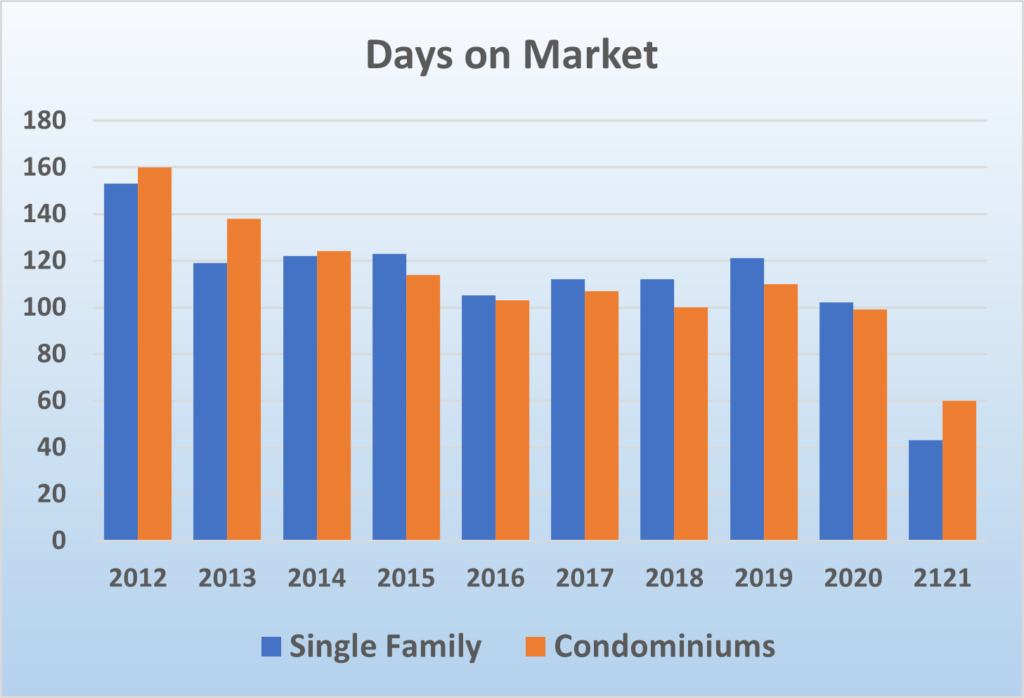

As we began 2012 the Sarasota Real Estate picture was well into recovery following the real estate market collapse of 2008, hitting some significant records as years of bank-owned homes, foreclosures and short sales finally ended. The market was on a healthy trajectory. Comparing the last 10 years shows we had 8 years of relatively steady growth.

In 2020 inventory fell to near-record levels – but sales did not. While buyers may not have found exactly what they were looking for, they still wanted to relocate and buy something while they believed values would continue to increase. When they did find what they wanted in months or years ahead, an investment now would result in excellent ROI then.

Beginning in 2021 the effects of the pandemic driving buyers to our market and sellers to sit on the sidelines created an even greater surge in sales and decline in inventory. The graphs below show the stunning changes. While most of the transactions in my practice trade for more than $1 million, I have used $500,000 as the baseline data so you can get a bigger picture look of our housing conditions.

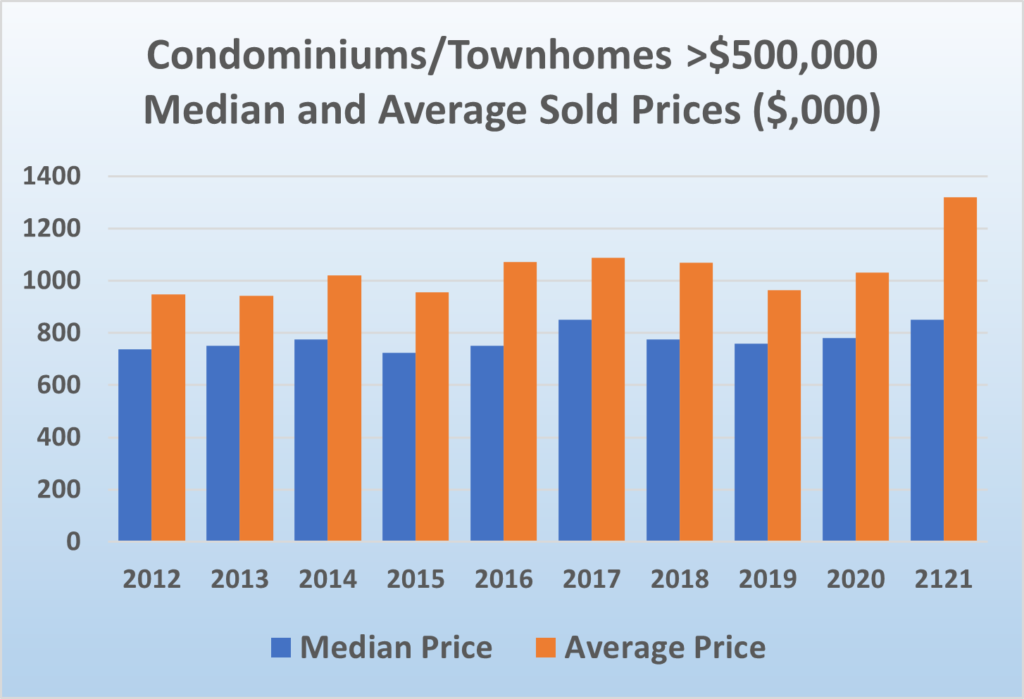

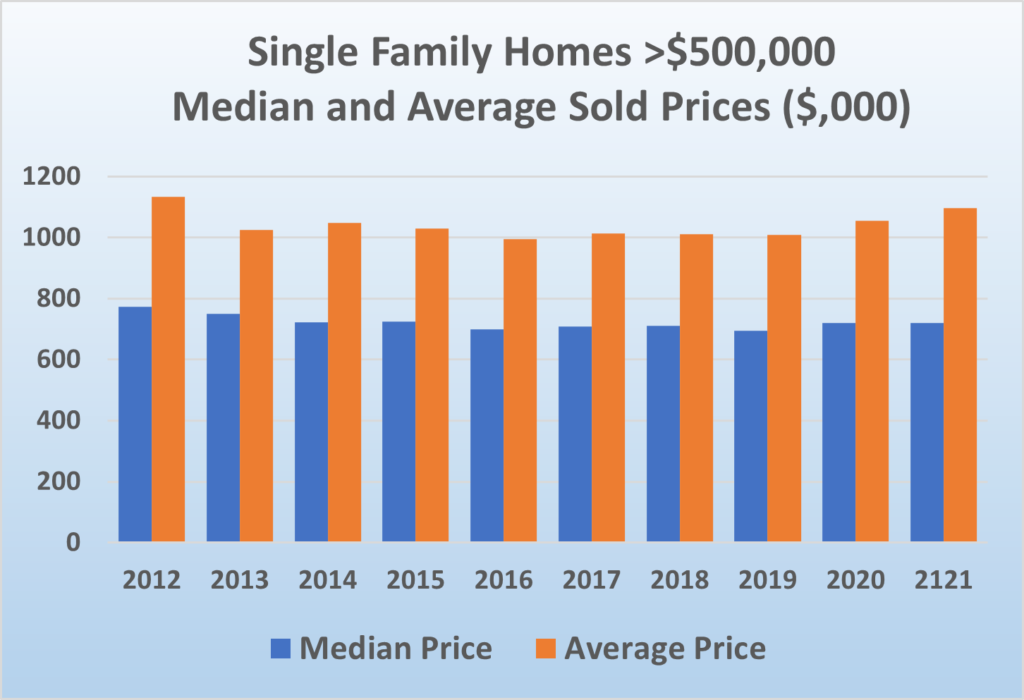

While recent news releases have been published suggesting that the Florida market, and our region in particular are reaching “overpriced” levels, I think the charts below support a different conclusion. Sarasota Real Estate prices do continue to grow, but as shown, the pace is relatively stable. The average per square foot price for homes and condos last year grew 13%, certainly not and over-inflated rate. The region remains an excellent value, especially when compared to our closest market competitors – the Naples area and southeast Florida.

Because several new luxury condominium projects have been completed in the last two years, there has been a more appreciable price growth in that market segment reflected in the higher average-priced properties. This should remain fairly steady in 2022 as additional luxury developments are under construction or planning stages with delivery later this year and in 2023.

Given the dramatic fall in inventory, one of the most challenging aspects of our market has become the number of days from listing to contract. Having been selling properties in Sarasota for 40 years, I count myself as fortunate to have established close relationships with my colleagues throughout the area. With these tight connections, I have been able to bring qualified buyers to my sellers within less than 24-hours, and find properties for my buyers that are sometimes not much more than a rumor when we are able to schedule our first showing. Competition for prized properties has been fierce and I know that my contemporaries will agree with me when I say, we have never seen market conditions like this!

The chart here shows the tremendous shift in listing to sale periods. And with a majority of our higher priced properties being sold without a mortgage, the time between contract to closing has also tightened.

I expect the intense “bidding” to continue for properties in highly desirable locations, in good condition, and with updated technology and security, kitchens and baths, and the important amenities today’s buyers are seeking.

(All data used for charts in this report derived from MLS and Trendgraphix)

The 2022 Market

The insatiable demand for Sarasota properties is not expected to wane, especially as the borders reopen and our Canadian, European, and South American buyers return.

The Sarasota region has been ranked in several recent studies as one of the strongest “emerging” markets for all the reasons most of us are familiar with – lifestyle, economic vitality and cost of living, climate, wide variety of housing types and attractive locales, and of course our rich dining, arts, entertainment, and cultural offerings. These factors will continue to attract those migrating from our key driver markets in the Northeast, Midwest, and Western states.

I believe first quarter 2022 will be robust, as the pace of inquiries I have received since the calendar rolled over is at least as brisk as same period last year. A sentiment heard from all my other established colleagues working in the luxury and ultra-luxury tiers.

Inventory of new homes and condos is growing at a steady pace but will still not able to fill the incredible demand for them. Renovation and rebuilds are occurring in all sectors and price tiers, resulting in home builder and remodelers enduring confidence. Employment in the field is improving, however supply chain issues are not only causing delays in delivery of properties and inability to work off a considerable backlog of projects, but also causing unexpected cost increases.

The imbalance between buyers and sellers will remain for the foreseeable future. With a lingering seller’s market, prices will grow, but unlikely at the pace of 2021. I do think we will see more sellers listing their properties in 2022 believing that their properties have reached peak ROI. As the year progresses, I also think we will see a slight decline in “migration buying” since many have either already secured a home or are looking at other investment opportunities.

To my potential sellers, this is a virtual once-in-a-lifetime opportunity to be in a strong negotiating position, control of the contingencies and timing of a closing, and with less of the more typical improvements and upgrades needed before sale. Sales have reached a 98% rate of list-to-sale prices, the highest I have ever seen in the Sarasota Real Estate Market. Let’s talk if you are ready to enter this amazing seller’s market!

As you consider your real estate goals for the year ahead, whether buying or selling, having a professional with a critical and analytical approach, an understanding of the realities, and able to set expectations based on pragmatic and practiced conclusions will ensure your goals are achieved.

With decades of experience managing hundreds of transactions, and experiencing the Sarasota Real Estate Market’s variability, my knowledge throughout the region can help. Whether looking to move to Sarasota, relocate to a new neighborhood, considering upsizing or downsizing, or adding to your real estate portfolio, I would be happy to discuss your next steps with you.

And now for my statistical report on the December Sarasota Real Estate Market activity:

Sales

- Total market dollar volume this past month was $734.5 million which decreased by $12.5 million from a year ago.

- Broken down, single-family sales were $512.1 million and condo sales were $222.4 million for the month.

- The number of properties sold this past month was 1,249, which is 287 less than a year ago. The sales total includes 837 houses and 412 condos. The monthly average of sold properties this year is 1,369. The monthly sold properties average was 1,179 in 2020 and 1,074 in 2019.

- Florida’s single-family sales decreased 1.6% from last year, and condo sales were virtually equal to last year. Homes sold for more than $1 million were 21% higher than December 2020 and condos closed at over $1 million grew 42.8%.

- U.S. sales of single-family homes fell 6.8% and condo sales dropped 9.6%.

- Of the closed sales in the Sarasota Real Estate Market this past month 120 were for over $1,000,000, 79 were houses and 41 were condominiums.

- In 2021 Sarasota averaged 83 house sales and 45 condo sales per month over a $1 million, though a relatively small portion of our overall sales, this tier has had significant growth over the last two years.

- Last month 961 listings went pending, a decrease of 195 transactions from a year ago. For 2021 the monthly average for pending sales was 1,122 and in 2020 it was 1,264. With new listings nearly equaling monthly pending sales, inventory is remaining extremely low.

- Florida’s single-family pending sales fell 4.2% and condos were off 2.4% compared to last year.

- U.S. pending sales in December were 6.0% behind of a year ago.

Prices

- Single-family homes were sold at a median price of $435,788. The 2021 monthly median price for houses sold was $394,000 and in 2020 it was $321,000.

- In December, Florida median price for single-family homes was $373,990, a 21% increase over last year.

- The national median price for existing homes grew 16.1% to $364,300.

- The condo median sale price was $360,000. The 2021 monthly median price was 317,000 and in 2020 it was $255,000.

- Median price for a Florida condo last month was $285,000, a 23.9% increase over December 2020.

- U.S. median condo price grew to $305,100, an 11.9% increase.

- Sarasota houses sold on average in December for $611,828 where the 2021 monthly average was $572,831 and in 2020 it was $455,000.

- Condos sold for an average price of $539,738 last month. The condo monthly average sale price in 2021 was $527,000 and in 2020 it was $382,000.

Inventory

- Currently there are 829 properties for sale in Sarasota. This is a decrease of 134 listings from the month before. There were 2,272 at the end of 2020, 4,086 at the end of 2019 and 5,401 at the end of 2018. Based on the number of available listings at the end of this year vs. the previous three years one can understand why we are in a seller’s market.

- Of the available inventory for sale, 241 properties are listed for over $1 million. Of the active listings over $1,000,000, 168 are houses (33.6% fewer than last year) and 73 are condos (50% fewer than last year).

- The Sarasota market had 945 new listings the past month. The market averaged 1,321 new listings this year.

- Current inventory results in 0.6 months of single-family homes for sale in Sarasota and 0.6 month’s supply of condominiums.

- Florida currently has 1 month of single-family inventory and 1.3 month’s supply of condominiums. Inventory of properties selling for over $1 million have decreased about 30% from last year.

- U.S. inventory of existing homes and condos is down 14.2% and at 1.8 months of supply.