In this “welcome back” issue of my monthly report I focus on our year through the 3rd quarter. While Katie and I traveled more than 5,000 miles up and down the eastern US this summer, we spent countless hours studying the housing market on a more macro stage. Whether exploring the markets in South and North Carolina’s most popular and coveted beach, mountain and golf communities, or the more urban settings in DC, Connecticut, and New York, one thing is certain, each is facing a real estate market that is both dynamic and evolving.

It is Still a Seller’s Market

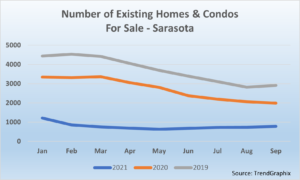

Inventory is the Sarasota area’s dominating factor. The attached graph illustrates the extraordinary decline in available properties for sale.

Inventory is the Sarasota area’s dominating factor. The attached graph illustrates the extraordinary decline in available properties for sale.

However, it is important to note that, as low as inventory is in the Sarasota Real Estate Market, conditions appear to be leveling off, and even (ever-so) slightly improving.

In the last three months I have noticed possible sellers choosing to wait to list their properties. Their strategy, and one which I tend to agree with in most of those I am advising, is that the affluent buyers are typically not in our marketplace in late summer and early fall.

Instead, these sellers are waiting for the peak tourist season to get underway, our seasonal residents to return and begin their searches for their next move, and for the arrival of our European buyers who have been absent from our buyer pool for most of the last two years.

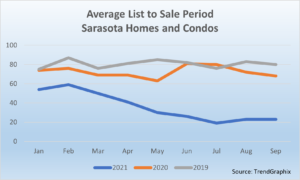

For my clients who are bringing their properties market, the breakneck pace that our region has seen over the last year makes it hard not to be overconfident when pricing their homes. With purchase prices nearly 100% of list prices recently, it is understandable for a seller to want to price their property “optimistically” and above recent comps in their community.

However, I believe the shrewd decision for most homeowners is to remain competitive and allow the buyers to bring their highest and best offer to the table.

Is a Buyer Offering Full Price Enough?

Sometimes. Though I do not know the actual statistic for the Sarasota area, in the U.S. the average number of offers an existing home is receiving today is 3.8, according to the National Association of Realtors. And a recent report from CoreLogic showed that almost 6 of 10 homes are selling for over asking price.

Being an active advisor for buyers and sellers in the Sarasota Real Estate Market for almost 40 years has given me the experience to guide buyers with a critical and analytical approach. Knowing the market as I do gives me the chance to advise my clients with clear understanding of the realities and helps to set reasonable expectations and assures that we are approaching each offer with the buyer’s goals at the forefront.

Being an active advisor for buyers and sellers in the Sarasota Real Estate Market for almost 40 years has given me the experience to guide buyers with a critical and analytical approach. Knowing the market as I do gives me the chance to advise my clients with clear understanding of the realities and helps to set reasonable expectations and assures that we are approaching each offer with the buyer’s goals at the forefront.

In fact, in this “auction-like” environment, in which demand continues to be unwavering and supply remains well below inventory levels to meet that demand, it is easy for buyers to panic and potentially rush to make a desperate offer.

My buyers are beginning to understand that while they may not find their “ideal” property right now and are expanding their search criteria, and even choosing to buy something to live in now knowing it will appreciate. This allows them time to wait for the property they really want to come on the market.

These savvy buyers often are rewarded if they are living in our market, able to view the property in person as soon as it is known to be available, and move more quickly and confidently, which is more appealing to sellers when they are accepting multiple offers.

I have seen in these instances some buyers getting lucky in finding their dream home…and in others, buyers back out of their contracts after they have taken time to fully evaluate the home’s condition, location, or other key factors. My advice is to take a breath and listen to your realtor!

I have seen in these instances some buyers getting lucky in finding their dream home…and in others, buyers back out of their contracts after they have taken time to fully evaluate the home’s condition, location, or other key factors. My advice is to take a breath and listen to your realtor!

In most cases, we not only know the properties intimately, we also know the agent representing the seller and can offer our buyers vital information and stratagems to achieve their goals.

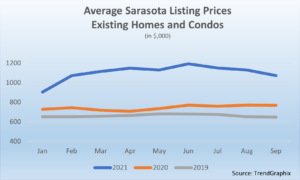

Prices Continue to Rise

Here the laws of supply and demand are absolutely in play. With less than one-month’s inventory of homes and condos for sale in the Sarasota Real Estate Market, basic econ 101 is at work in housing supply.

Insufficient new construction, sellers hesitant to consider their own move for much of the last 20 months, and homeowners staying in homes longer than any period on record are just a few of the reasons for our anemic supply.

Builders have been able to maintain a relatively steady pace of construction. However, the well-reported supply chain disruptions are creating crippling delivery delays, chronic construction labor shortages, and costs of materials are skyrocketing for many products – imagine steel and iron are up 95%, aluminum 63%, and the seesaw pricing of lumber – which is causing much uncertainty in new home markets. Not only is the timing delivery of a new home difficult to project, but also median prices for a new home have escalated from $325,000 in 2020 to $391,000 in 2021 and are expected to continue to increase.

Is the Market at Risk of a Crash?

Simply put – NO. Many still live in fear of the 2008 crash and are worried we are once again in a housing bubble. As noted earlier in this report – today’s conditions are a result of simple supply and demand.

COVID motivated thousands to rethink their housing wants and needs. Pent-up demand caused by the economy shut-down last year restrained or all-out stopped buyers and sellers from any housing decisions.

What we are experiencing in the Sarasota Real Estate Market is “price appreciation” vs 2008’s “price inflation”. We must remember that 2008 was a combination of elements – a credit crisis, real estate crisis, and an economic crisis.

Real estate market analysts are predicting price escalations will slow to 3% or less on a national basis by fall of 2022, but between now and then, expect many more months of the same double-digit price growth in this healthy real estate market.

The art of buying and selling property in these unfamiliar conditions requires experience, skill, and a deep understanding of the realities of the market. Local knowledge, decades of effectively managing buying and selling transactions, and successfully navigating a variety of economic and unusual market conditions allows me to provide my clients clear vision throughout the process, ensuring that expectations and goals are achieved.

Whether looking to relocate to a new neighborhood, considering upsizing or downsizing, or adding to your real estate portfolio, I would be happy to discuss your next steps with you.

And now for my statistical report on the August Sarasota Real Estate Market activity:

Sales

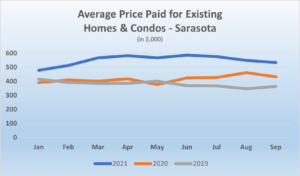

- Total market dollar volume in August was $609.9 million, which increased by $38.2 million from a year ago.

- Broken down, single-family sales were $452.7 million, and condo sales were $157.2 million for the month.

- The number of properties sold in the month was 1,156, which was 115 less than a year ago. The sales total includes 815 houses and 341 condos.

- The monthly sold properties average in 2021 is 1,466, was 1,179 in 2020, and 1,074 in 2019

- Florida’s single-family sales were virtually even with last year, and condo sales were 13% more than last year.

- U.S. sales of single-family homes declined 2.8% and condos increased 9.5%.

- Of the closed sales in the month, 90 were for over $1,000,000, 68 were houses and 22 were condominiums.

- In 2020 Sarasota the market averaged 50 house sales and 23 condo sales per month over a $1 million.

- During August 1,271 listings went pending, a decrease of 80 transactions from a year ago. Year to date the monthly average is 1,471 listings go to pending sales, and for 2020 it was 1,264. This year’s slight decline is a result of a comparison to last year’s pent-up buying demand following the pandemic’s economic shutdown.

- Florida’s single-family pending sales decreased 4.7% and condos rose 3.7% compared to last year.

- U.S. pending sales in July were more than 8% below a year ago.

Prices

- Single-family homes were sold at a median price of $390,093. The 2020 monthly median price for houses sold was $321,000.

- In August, Florida median price for single-family homes was $354,000, an 18% increase over last year.

- The national median price for existing homes grew 15.6% to $363,800.

- The condo median sale price was $315,000. The 2020 monthly median price was $255,000.

- Median price for a Florida condo last month was $252,500, a 16.1% increase over August of 2020.

- U.S. median condo price grew 10.8% to $302,800.

- Sarasota houses sold on average for $555,508 where the 2020 monthly average was $455,000.

- Condos sold for an average price of $461,046 in August. The condo monthly average sale price in 2020 was $382,000.

Inventory

- Currently there are 1,054 properties for sale in Sarasota. This is an increase of 110 listings from the month of May which was my last report. There were 2,272 at the end of 2020, and 4,086 listings at the end of 2019.

- The Sarasota market had 1,271 new listings in August. The market has averaged 1,410 new listing per month this year, and 1,040 new listings in 2019.

- Current inventory results in 0.8 months of single-family homes for sale in Sarasota and 0.6 month’s supply of condominiums.

- Florida currently has 1.3 months of single-family inventory and 1.7 month’s supply of condominiums.

- U.S. currently has 2.6 months of supply of unsold inventory.