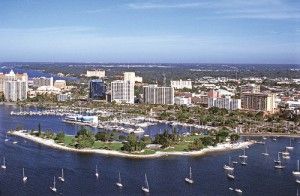

The Moulton Sarasota Real Estate Report – January 2013

A Strong Start For Sarasota’s 2013 Housing Market

The New Year is showing that the housing market recovery is indeed healing. Even though we’re only two months into the year, the early results are signaling that the recovery we saw last year will continue. Each of the key indicators that I watch have been moving in the right direction for months: sales are consistently higher, median prices are growing, each month pending sales are strong, inventory is shrinking, building permits are steadily increasing, and length of time from listing to sale is narrowing. With all of these factors exhibiting constant improvement, I am more than convinced that our housing market is poised to maintain its course of stabilization and revival.

Sales

Once again sales showed considerable growth. In the combined Sarasota-Manatee area, sales beat last January’s by more than 20% and prices in the dual county zone were almost 18% higher than the same time last year. Condominium demand softened a touch but interest in single family homes – both new and existing – were impressive. The National Association of Realtors stated in this month’s report that buyer traffic is 40% higher than 2012. As demand presses prices upward, the number of negative equity homes will fall, encouraging those homeowners to add their properties to our available inventory, and it is expected that this movement will help to keep prices from increasing too rapidly. In addition, given the consistent price increase our region is seeing, I am very hopeful this will encourage buyers to take swift action on our somewhat limited inventory in the most highly desirable locations.

- Closed transactions in Sarasota during January were 17% higher than January 2012. Our entire North Port-Manatee-Sarasota MSA showed sales 20.5% higher.

- Florida sales in January were almost 12% better than last year, with all cash sales 15% higher than last year indicating a strong inflow of investors to the state. In addition, days-on-market for listings in the state has fallen 15% compared to last January.

- On a National scale, existing home sales have increased 10%% from January 2012.

- Single-family median sale price (median represents the midway price where half of the sales were above and half were below this price) for all Sarasota transactions last month was $183,800 vs. $162,000 a year ago, a 14% increase over last year. Our greater regional MSA area saw an 18% median price increase for single-family homes.

- Florida State’s median price for single-family homes climbed more than 12% and condos had an 18% growth from last January. This is the 13th consecutive month of price increase in the state.

- Zillow reported this month that national home values have risen 6.2% since last year and there have now been 15 straight months of home appreciation. Median prices have increased 12.3% nationally, and are now the highest since November 2005.

- Sarasota condo median sales price was $130,000 vs. $180,000 a year ago. Last month’s anomaly of a disproportionate number of sub-$100,000 price range sales created the downward movement and it is not expected to recur.

Pending Sales

Pending home sales are a leading indicator of the activity expected to come in the next month or two. It also helps us to determine market stability and what coming trends may be. The trend that we have seen for much of the last year continued with impressive pending sales improvement. This last month set us at the highest level in the last 9 months.

- Sarasota’s single-family properties under contract but not yet closed in January increased 15.6% over last January, 911 vs. 788 a year ago.

- Number of days from listing to sale in Sarasota has fallen almost 20% since last year.

- Pending sales for single-family homes in Florida last month jumped 31%.

Inventory

Inventory remains our market’s hot topic and the question, “How far can inventory fall?” is asked regularly. Since last year available single-family homes have dropped 35% and condominium inventory has contracted by more than 50%. Housing permit applications continue to grow with Sarasota awarding an increase of 86% more single-family permits than last year. The value of those new homes is also improving with the new home construction representing a value increase of 56%. Despite the future growth from these new properties, we are still in need of immediate listings to help to bring the market into better balance. A market is considered balanced between sellers and buyers when total inventory hovers around six months of supply, though in the higher priced categories, a stable inventory is considered 12-18 months. The following data shows that we are well below the targeted balanced market.

- Available listings in Sarasota have decreased 16% from a year ago but are up from the end of December which reflects sellers recognizing the value of listing their properties during spring selling season.

- Based on sales in January, our region is sitting at approximately just over five months of supply.

- The present listed inventory remains the lowest it has been in a decade.

- There are now just 4 months of inventory for properties listed under $500,000.

- In the segment between $500,000 and $1,000,000, there is a 15-month supply.

- At the luxury level over $1,000,000, the available inventory is a 50-month supply. This is a high number reflecting that there were not many closed luxury sales in January and we were fortunate to see growth in listings in this category.

- Four years ago the inventory was over 9,500 units, and properties for sale today sits at just 3,500.

- Nationally, listed inventory has fallen more than 25% since last year and is now the lowest since December 1999.

- Currently 470 properties listed for sale are shorts sales or foreclosures, which represents 12.2% of listed properties, down from 17% in January 2012.

After reviewing all of the statistical evidence from the January market reports, I truly believe that the basics of economics – supply and demand determines price – are clearly at work. With a stabilizing foreclosure market, our incredible community igniting a real migration, our recovery is holding steady and without any abrupt gains or losses within the key indicators, there is good reason for market specialists like myself to have confidence in our region’s real estate strength. Economic reports showed our hotel/motel sales in Sarasota rose more than 23%, and with tourism one of our major market drivers this bodes well for more positive developments in our real estate market. With projected continued sales growth during our next three peak selling months, more compression in the inventory situation, gradual price acceleration, you can see why I know we can look forward to a solid season.

The following statistical data is provided through the Sarasota Association of Realtors by agents within our local board. The table summarizes what happened in each price segment. The Sold, Pending Sale and Listed columns are sales and new listings for the month of the report, and the Pending Total and Listed Total are the current totals of each. YTD (Year to Date).